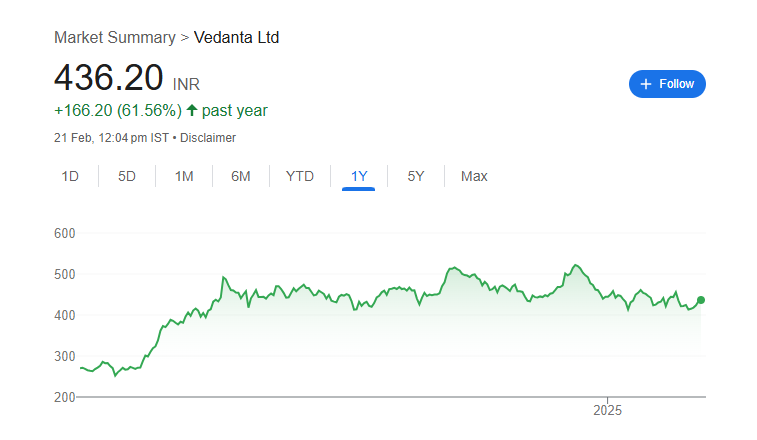

Vedanta Limited is a well-known company in the natural resources sector, dealing with metals, mining, and energy. Its share price is influenced by various factors, including global commodity trends, economic conditions, and company performance. Investors closely watch Vedanta’s stock as it has the potential for growth but also faces challenges like market fluctuations and regulatory changes. Vedanta Share Price on 21 February 2025 is 436.20 INR. This article will provide more details on Vedanta Share Price Target 2025, 2026 to 2030.

Vedanta Share Price Chart

Vedanta Share Details

- Open: 435.25

- High: 442.25

- Low: 432.60

- Previous Close: 433.50

- Volume: 6,174,983

- Value (Lacs): 26,904.40

- VWAP: 438.25

- UC Limit: 476.85

- LC Limit: 390.15

- 52 Week High: 526.95

- 52 Week Low: 249.50

- Mkt Cap (Rs. Cr.): 170,388

- Face Value: 1

Vedanta Share Price Target 2025 To 2030

- 2025 – ₹530

- 2026 – ₹750

- 2027 – ₹930

- 2028 – ₹1145

- 2029 – ₹1360

- 2030 – ₹1575

Vedanta Shareholding Pattern

- Promoters: 56.38%

- Mutual Funds: 7.16%

- Foreign Institutions: 12.02%

- Domestic Institutions: 8.33%

- Retail and Other: 16.11%

Major Factors Affecting Vedanta Share Price

Vedanta Limited is one of India’s leading natural resources companies, dealing in metals, mining, and oil and gas. Its share price is influenced by several factors that impact its business operations and market value. Here are some key factors that affect Vedanta’s share price:

-

Commodity Prices

Vedanta’s business is heavily dependent on the prices of commodities like aluminum, zinc, copper, and crude oil. If global metal and oil prices rise, Vedanta’s revenues and profits increase, leading to a positive impact on its share price. However, if prices fall, the company’s earnings may decline, affecting investor sentiment. -

Government Policies and Regulations

Mining and metal industries are subject to various government regulations related to environmental norms, mining leases, and export-import policies. Any changes in these regulations, such as increased taxes or restrictions on mining activities, can impact Vedanta’s financial performance and its stock price. -

Financial Performance

Quarterly and annual financial results play a crucial role in determining the company’s stock price. Strong revenue growth, profitability, and efficient cost management attract investors, while declining profits or rising debt levels can negatively impact the stock. -

Global Economic Conditions

Since Vedanta operates in the international market, global economic trends significantly influence its share price. Economic slowdowns, trade restrictions, or inflationary pressures can reduce demand for metals and energy, affecting the company’s revenues and stock performance. -

Merger and Expansion Plans

Vedanta’s expansion strategies, acquisitions, and investments in new projects impact investor confidence. Positive developments, such as increased production capacity or strategic partnerships, can boost the share price, while delays or failed projects may lead to a decline.

Risks and Challenges for Vedanta Share Price

Vedanta Limited, being a major player in the natural resources sector, faces several risks and challenges that can impact its share price. Investors should be aware of these factors before making investment decisions. Here are some key risks and challenges for Vedanta’s share price:

-

Fluctuations in Commodity Prices

Vedanta’s earnings are directly linked to the prices of metals like aluminum, zinc, copper, and oil. If global commodity prices decline due to lower demand or oversupply, the company’s revenues and profits can be negatively affected, leading to a drop in share price. -

Regulatory and Environmental Risks

The mining and energy sectors are highly regulated. Government policies on environmental protection, mining permissions, and taxation can change unexpectedly. If stricter regulations or legal challenges arise, Vedanta may face operational hurdles, impacting its profitability and stock value. -

Debt and Financial Burden

Vedanta has a significant amount of debt, and high borrowing costs can impact its financial health. If the company struggles to repay loans or faces difficulty in securing funds for expansion, investor confidence may decline, leading to a fall in share price. -

Global Economic Slowdown

A weak global economy can reduce the demand for metals and energy products, affecting Vedanta’s sales and profits. Economic downturns, trade restrictions, or currency fluctuations can also create uncertainty in the stock market and negatively affect Vedanta’s valuation. -

Operational and Political Risks

Vedanta operates in multiple countries, and political instability, labor strikes, or operational disruptions can impact production and revenue. Any unfavorable changes in government policies, geopolitical tensions, or protests against mining activities can create uncertainties for investors.

Read Also:- South Indian Bank Share Price Target 2025 To 2030- Chart, Market Overview, More Details