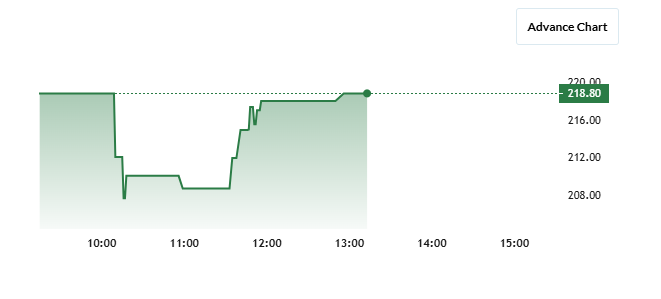

Urban Enviro Waste Management Ltd is a promising company in the waste management and environmental services sector. As cities grow and sustainability becomes a priority, the company’s role in clean and efficient waste solutions continues to expand. Investors track its share price to understand market trends, company performance, and future growth potential. Urban Enviro Share Price on 24 February 2025 is 218.80 INR. This article will provide more details on Urban Enviro Share Price Target 2025, 2026 to 2030.

Urban Enviro Share Price Chart

Urban Enviro Share Details

- Open: 218.80

- High: 218.80

- Low: 207.60

- Previous Close: 217.10

- Volume: 21,600

- Value (Lacs): 47.26

- VWAP: 213.24

- UC Limit: 227.95

- LC Limit: 206.25

- 52 Week High: 347.58

- 52 Week Low: 132.73

- Mkt Cap (Rs. Cr.): 94

- Face Value: 10

Urban Enviro Share Price Target 2025 To 2030

- 2025 – ₹350

- 2026 – ₹445

- 2027 – ₹540

- 2028 – ₹650

- 2029 – ₹760

- 2030 – ₹755

Urban Enviro Shareholding Pattern

- Promoters: 51.19%

- Mutual Funds: 0%

- Foreign Institutions: 0.06%

- Domestic Institutions: 0%

- Retail and Other: 48.76%

Major Factors Affecting Urban Enviro Share Price

Here are five major factors that can influence Urban Enviro Waste Management Ltd’s share price, explained in a simple and soft tone:

1. Financial Performance

The company’s financial health plays a significant role in determining its share price. For instance, as of February 21, 2025, Urban Enviro Waste Management’s share price was ₹220.2, reflecting an increase of 14.12% over the past year. Consistent growth in revenue and profits can boost investor confidence, leading to a rise in share price.

2. Market Demand for Environmental Services

Urban Enviro Waste Management operates in the environmental services sector. An increase in demand for waste management and environmental solutions, driven by urbanization and environmental awareness, can positively impact the company’s sales and, consequently, its share price.

3. Regulatory Environment

The company must adhere to environmental regulations and policies. Changes in regulations, such as stricter waste management laws, can affect operational costs and processes. Compliance with these regulations is crucial for maintaining the company’s reputation and financial stability, which in turn influences the share price.

4. Competitive Landscape

The environmental services industry is competitive, with multiple players striving for market share. Urban Enviro Waste Management’s ability to offer innovative and cost-effective solutions can set it apart from competitors. Maintaining a competitive edge is essential for sustaining and potentially increasing the company’s share price.

5. Economic Conditions

Broader economic factors, such as GDP growth and industrial activity, influence the demand for environmental services. A robust economy can lead to higher demand for the company’s services, boosting sales and share price. Conversely, economic downturns may have the opposite effect.

Risks and Challenges for Urban Enviro Share Price

Here are five risks and challenges that can affect Urban Enviro Waste Management Ltd’s share price, explained in a simple and soft tone:

1. Regulatory and Compliance Risks

Since Urban Enviro operates in the waste management and environmental sector, it must follow strict government regulations. Changes in policies related to waste disposal, recycling, or pollution control could increase operational costs. If the company fails to comply with these regulations, it may face legal penalties or restrictions, which can negatively affect investor confidence and the share price.

2. Fluctuations in Operational Costs

Waste management requires equipment, labor, transportation, and disposal facilities. If the costs of fuel, labor, or waste processing increase, it could reduce the company’s profit margins. A decline in profitability may lead to lower investor confidence and impact the share price.

3. Competition in the Waste Management Industry

The waste management sector is highly competitive, with both local and national players offering similar services. If competitors provide better pricing, advanced technology, or superior services, Urban Enviro might lose market share. A declining market position can result in lower revenue and a drop in stock value.

4. Economic Slowdowns and Market Demand

The demand for waste management services is linked to industrial growth, urbanization, and construction activities. During economic downturns, businesses and municipalities may cut budgets for waste management, leading to reduced contracts and lower revenue for the company. This could have a negative effect on the share price.

5. Public Perception and Environmental Concerns

Being in the waste management industry, Urban Enviro is expected to operate with strong environmental and ethical standards. If the company faces negative publicity due to improper waste disposal, pollution issues, or community complaints, it could damage its brand reputation. A poor public image may lead to fewer contracts, legal issues, and a decline in stock value.

Read Also:- Time Technoplast Share Price Target 2025 To 2030- Chart, Market Overview, More Details