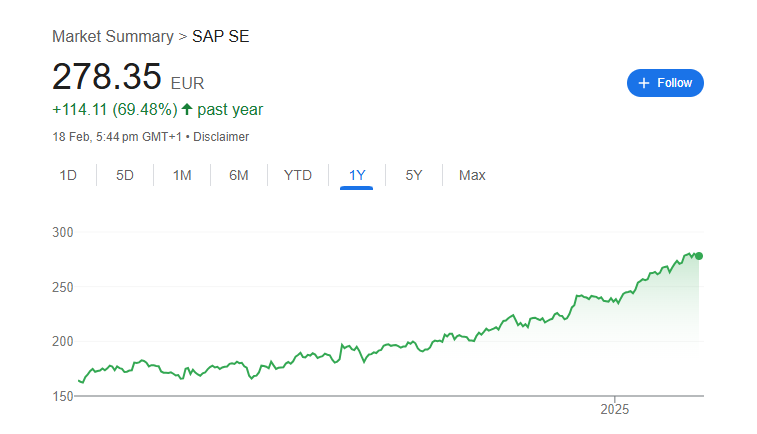

SAP is one of the world’s leading software companies, known for its enterprise solutions that help businesses manage operations efficiently. The company’s share price reflects its strong market presence, innovation, and global demand for cloud-based solutions. Investors closely watch SAP’s stock performance as it is influenced by business growth, competition, and economic trends. Sap Share Price on 19 February 2025 is 278.35 EUR. This article will provide more details on Sap Share Price Target 2025, 2026 to 2030.

Sap Share Price Chart

Sap Share Details

- Open: 279.45

- High: 280.95

- Low: 277.35

- Mkt cap: 34.37KCr

- P/E ratio: 105.14

- Div yield: 0.79%

- 52-wk high: 281.35

- 52-wk low: 161.68

Sap Share Price Target 2025 To 2030

- 2025 – EUR 290

- 2026 – EUR 405

- 2027 – EUR 510

- 2028 – EUR 623

- 2029 – EUR 740

- 2030 – EUR 820

Major Factors Affecting Sap Share Price

SAP is a global leader in enterprise software, helping businesses manage operations efficiently. Its share price is influenced by various internal and external factors. Here are five key factors affecting SAP’s share price:

-

Financial Performance and Revenue Growth

SAP’s quarterly and annual earnings reports have a direct impact on its share price. If the company shows strong revenue growth, higher profit margins, and increasing software subscriptions, investor confidence rises, leading to a higher share price. Any decline in revenue or lower-than-expected earnings can negatively affect stock value. -

Technological Innovation and Product Demand

As a technology company, SAP’s success depends on its ability to innovate and adapt to changing market needs. The demand for cloud computing, artificial intelligence, and enterprise resource planning (ERP) solutions plays a major role in its stock performance. If SAP introduces new and advanced software solutions, it can attract more customers, boosting its share price. -

Global Economic Conditions

Since SAP operates worldwide, global economic factors such as inflation, interest rates, and economic downturns can influence its share price. In times of economic uncertainty, businesses may reduce their IT spending, which can affect SAP’s revenue and investor confidence. -

Competitive Landscape

The presence of strong competitors like Oracle, Microsoft, and Salesforce impacts SAP’s market position. If SAP manages to stay ahead by offering better solutions and services, its share price can rise. However, increased competition and loss of market share can lead to a decline in stock value. -

Mergers, Acquisitions, and Strategic Partnerships

SAP’s partnerships and acquisitions help it expand its market reach and enhance its technology offerings. A successful acquisition of a promising tech company or a strategic partnership can boost investor confidence and increase the share price. On the other hand, failed mergers or poor integration of acquired companies can have a negative impact.

Risks and Challenges for Sap Share Price

SAP is a well-established global technology company, but like any business, it faces certain risks and challenges that can impact its share price. Here are five key risks that investors should be aware of:

-

Slow Cloud Adoption and Transition Risks

SAP is shifting from traditional software licensing to cloud-based solutions. While the cloud business is growing, a slow transition or customer hesitation in adopting SAP’s cloud services could impact revenue. If cloud subscriptions do not meet expectations, it may affect the company’s stock performance. -

Intense Market Competition

SAP faces strong competition from tech giants like Oracle, Microsoft, and Salesforce. If competitors offer better or more affordable enterprise software solutions, SAP could lose market share. Losing customers to rivals or failing to keep up with industry trends can negatively impact its share price. -

Economic Uncertainty and IT Spending Cuts

In times of economic downturns or financial instability, businesses tend to cut down on IT spending. Since SAP’s revenue depends on companies investing in enterprise software, reduced spending can slow down its growth and affect its stock value. -

Regulatory and Compliance Risks

As a global company, SAP must comply with different data privacy laws, tax regulations, and trade policies across multiple countries. Any legal issues, fines, or non-compliance with government regulations could harm the company’s reputation and stock performance. -

Cybersecurity Threats and Data Breaches

Since SAP deals with vast amounts of sensitive business data, cybersecurity threats and potential data breaches pose significant risks. Any major security incident could lead to financial losses, legal liabilities, and a decline in investor confidence, impacting its share price.

Read Also:- Dell Share Price Target 2025 To 2030- Chart, Market Overview, More Details