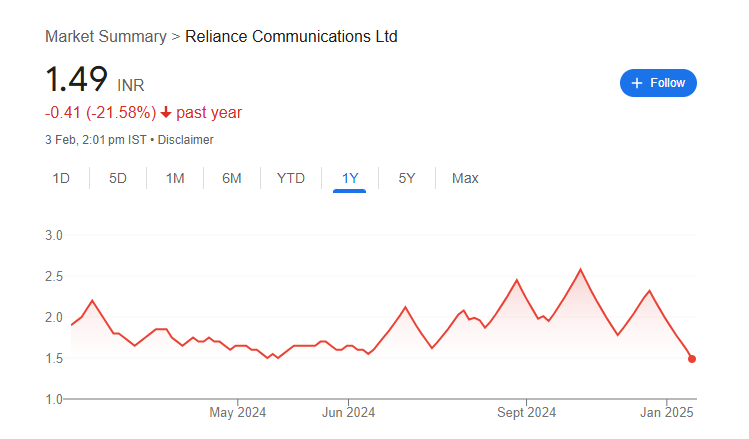

Investors looking at Reliance Communications (RCOM) share price target are often curious about its future growth potential. Once a major player in India’s telecom sector, RCOM has faced financial struggles, legal challenges, and stiff competition. While some investors hope for a turnaround, others remain cautious due to its ongoing insolvency proceedings. RCOM Share Price on 03 February 2025 is 1.49 INR. This article will provide more details on RCOM Share Price Target 2025, 2026 to 2030.

RCOM Share Price Chart

RCOM Share Details

- Open: 1.45

- High: 1.51

- Low: 1.45

- Previous Close: 1.53

- Volume: 10,359,192

- Value (Lacs): 154.35

- VWAP: 1.45

- UC Limit: 1.60

- LC Limit: 1.45

- 52 Week High: 2.58

- 52 Week Low: 1.45

- Mkt Cap (Rs. Cr.): 412

- Face Value: 5

RCOM Share Price Target 2025 To 2030

- 2025 – ₹2.60

- 2026 – ₹2.80

- 2027 – ₹3.10

- 2028 – ₹3.50

- 2029 – ₹3.90

- 2030 – ₹4.40

RCOM Shareholding Pattern

- Promoters: 1.85%

- Mutual Funds: 0.01%

- Foreign Institutions: 0.08%

- Domestic Institutions: 4.38%

- Retail and Other: 93.69%

Major Factors Affecting RCOM Share Price

Reliance Communications (RCOM) has faced significant financial and operational challenges over the years. However, various factors still influence its share price in the stock market. Below are some key factors affecting RCOM’s share price:

- Debt and Financial Stability

RCOM has been dealing with a heavy debt burden, leading to financial distress. Investors closely monitor the company’s efforts in debt restructuring and repayments. Any improvement in its financial position could positively impact the stock price, while unresolved debt issues may cause further decline. - Legal and Regulatory Challenges

The company has been involved in multiple legal disputes and regulatory challenges, including bankruptcy proceedings. Court decisions and government policies regarding the telecom sector can significantly impact RCOM’s market value and investor confidence. - Industry Competition and Market Position

The Indian telecom industry is highly competitive, dominated by players like Jio, Airtel, and Vodafone-Idea. RCOM’s inability to compete effectively in this dynamic market due to its financial troubles affects its stock price, as investors seek more stable alternatives. - Investor Sentiment and Market Trends

Since RCOM is considered a risky investment, overall market trends and investor sentiment play a major role in its stock movements. Any positive developments, such as asset monetization or debt resolution, may attract investor interest, while negative news can lead to sharp declines. - Government Policies and Spectrum Licenses

Telecom sector policies, spectrum auctions, and government decisions regarding the allocation of resources can impact RCOM’s future prospects. If the company manages to regain spectrum or receive favorable policy decisions, it could influence its share price positively. -

Business Revival and Strategic Partnerships

If RCOM can secure new business opportunities, form strategic alliances, or restructure its operations, it may regain investor trust. Potential deals with other firms or the sale of assets could provide financial relief and impact stock performance.

Risks and Challenges for RCOM Share Price

Reliance Communications (RCOM) has faced several difficulties in recent years, making its stock a high-risk investment. Here are five key risks and challenges affecting RCOM’s share price:

- Heavy Debt and Financial Crisis

RCOM has been struggling with a massive debt burden, leading to financial instability. The company has defaulted on loan repayments, causing concern among investors. Until it successfully resolves its debt issues, its stock price is likely to remain under pressure. - Ongoing Legal and Bankruptcy Proceedings

The company is undergoing insolvency proceedings, which brings uncertainty about its future operations. Legal battles with creditors, regulators, and partners add to the risk, as any unfavorable verdict can negatively impact the stock. - Declining Market Position

RCOM was once a key player in the telecom industry, but its failure to compete with giants like Jio, Airtel, and Vodafone-Idea has led to a sharp decline. The lack of significant market share and outdated infrastructure makes its revival difficult, affecting investor confidence. - Regulatory Uncertainty and Government Policies

Changes in telecom regulations, license fees, and spectrum policies can impact RCOM’s financial health. The company has also faced penalties and dues to the government, creating additional challenges that may weigh down its stock price. -

Limited Growth Prospects

Since RCOM has exited the telecom services market, its ability to generate revenue remains uncertain. Without a clear business revival plan, investors may hesitate to invest, limiting the stock’s growth potential.

Read Also:- RVNL Share Price Target 2025 To 2030- Chart, Market Capital, More Details