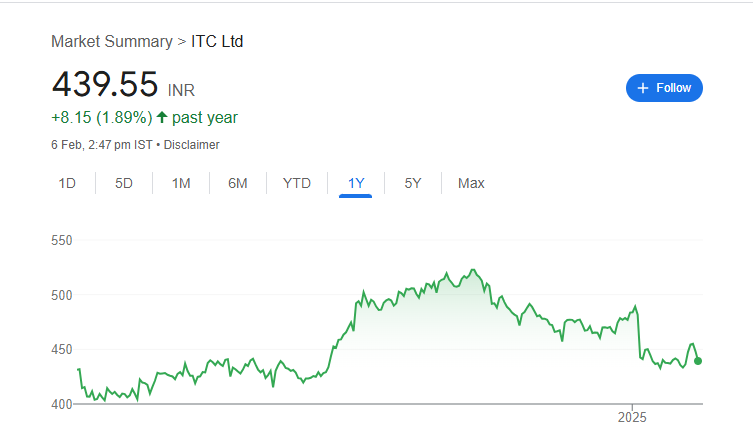

Investors are always keen to know the future of ITC’s share price, as it is one of India’s most trusted companies. With strong businesses in cigarettes, FMCG, hotels, and agriculture, ITC’s stock performance depends on various factors like industry trends, government policies, and financial growth. ITC Share Price on 06 February 2025 is 439.55 INR. This article will provide more details on ITC Share Price Target 2025, 2026 to 2030.

ITC Share Price Chart

ITC Share Details

- Open: 450.00

- High: 450.00

- Low: 438.20

- Previous Close: 448.15

- Volume: 13,361,722

- Value (Lacs): 58,738.13

- VWAP: 441.90

- UC Limit: 492.95

- LC Limit: 403.35

- 52 Week High: 528.50

- 52 Week Low: 399.35

- Mkt Cap (Rs. Cr.): 550,048

- Face Value: 1

ITC Share Price Target 2025 To 2030

- 2025 – ₹530

- 2026 – ₹560

- 2027 – ₹590

- 2028 – ₹620

- 2029 – ₹650

- 2030 – ₹680

ITC Shareholding Pattern

- Promoters: 0%

- Mutual Funds: 12.87%

- Foreign Institutions: 40.17%

- Domestic Institutions: 32.05%

- Retail and Other: 14.91%

Major Factors Affecting ITC Share Price

ITC Limited is one of India’s leading companies with a strong presence in multiple sectors, including cigarettes, FMCG, hotels, paper, and agriculture. Several key factors influence ITC’s share price, and understanding them can help investors make informed decisions.

1. Performance of Cigarette Business

ITC earns a significant portion of its revenue from cigarettes. Any changes in government regulations, tax hikes on tobacco, or shifting consumer preferences can impact sales. If cigarette sales decline, it may negatively affect ITC’s stock price, while strong demand can boost investor confidence.

2. Growth in FMCG Segment

ITC has been expanding its Fast-Moving Consumer Goods (FMCG) business with brands like Aashirvaad, Sunfeast, and Bingo. If the FMCG segment grows rapidly and contributes more to overall profits, it can improve the company’s long-term outlook and push the share price higher.

3. Government Policies and Regulations

ITC operates in industries that are highly regulated, especially tobacco and agriculture. Any strict policies, higher taxes, or advertising restrictions on cigarettes can impact revenue. Favorable policies, on the other hand, can support business growth and stock performance.

4. Market Sentiment and Economic Conditions

Stock prices are often influenced by investor sentiment and overall market trends. If the Indian economy is strong and consumption increases, ITC may benefit from higher sales across its various segments. However, during economic downturns, lower consumer spending can affect growth and share price movements.

5. Dividend Payout and Financial Stability

ITC is known for its consistent dividend payments, making it attractive to investors. A strong balance sheet, good profitability, and stable dividend payouts can support share price growth. However, if profits decline and dividend payouts decrease, it may negatively affect investor confidence.

Risks and Challenges for ITC Share Price

ITC Limited is a well-established company, but its share price can face various risks and challenges. Here are five key factors that may impact ITC’s stock performance:

1. Strict Government Regulations on Tobacco

Since ITC’s major revenue comes from cigarettes, government policies play a crucial role. Higher taxes, advertising bans, health warnings, or restrictions on smoking can negatively impact cigarette sales. Any unfavorable regulation can hurt ITC’s revenue and affect its share price.

2. Slow Growth in FMCG Business

ITC has been expanding in the FMCG sector, but competition from giants like Hindustan Unilever and Nestlé is tough. If ITC struggles to increase its market share or faces lower-than-expected growth in FMCG, investors might lose confidence, impacting the stock price.

3. Economic Slowdowns and Inflation

During economic downturns, people may cut back on discretionary spending, which can reduce demand for ITC’s FMCG and hotel businesses. Additionally, high inflation can increase raw material costs, reducing profit margins and impacting investor sentiment.

4. Environmental and Sustainability Challenges

ITC has businesses in paper, agriculture, and packaging, which depend on natural resources. Stricter environmental laws, deforestation concerns, or climate change-related disruptions could increase costs and affect long-term business sustainability, impacting the share price.

5. Market Sentiment and Volatility

Stock prices are influenced by investor sentiment, global market trends, and external factors like geopolitical tensions. If foreign investors reduce their holdings or the overall stock market declines, ITC’s share price might drop even if the company performs well.

Read Also:- Adani Green Share Price Target 2025 To 2030- Chart, Market Overview, More Details