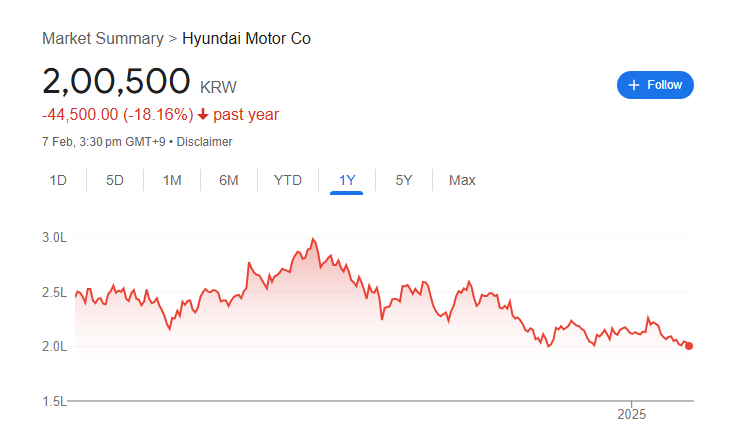

If you are interested in Hyundai Motor’s share price target, understanding the key factors affecting its stock is essential. As one of the world’s leading automobile manufacturers, Hyundai’s share price depends on global car demand, electric vehicle growth, competition, and market trends. In this article, we will explore Hyundai Motor’s stock performance, future potential, and the important elements that influence its price movements. Hyundai Motor Share Price on 07 February 2025 is 2,00,500 KRW. This article will provide more details on Hyundai Motor Share Price Target 2025, 2026 to 2030.

Hyundai Motor Share Price Chart

Hyundai Motor Share Details

- Open: 2,03,500 KRW

- High: 2,04,500 KRW

- Low: 2,00,000 KRW

- Mkt cap: 51.65LCr

- P/E ratio: 4.22

- Div yield: 5.99%

- 52-wk high: 2,99,500 KRW

- 52-wk low: 1,97,300 KRW

Hyundai Motor Share Price Target 2025 To 2030

- 2025 – KRW 2,99,500

- 2026 – KRW 3,30,500

- 2027 – KRW 3,50,500

- 2028 – KRW 3,74,500

- 2029 – KRW 4,01,500

- 2030 – KRW 4,45,000

Hyundai Motor Shareholding Pattern

- Promoters: 82.50%

- Mutual Funds: 5.10%

- Foreign Institutions: 6.70%

- Domestic Institutions: 2.03%

- Retail and Other: 3.67%

Major Factors Affecting Hyundai Motor Share Price

Hyundai Motor is one of the world’s leading automobile manufacturers, and its share price is influenced by several key factors. Here are six major factors that affect Hyundai Motor’s stock performance:

1. Global Vehicle Demand and Sales Performance

The demand for Hyundai’s cars plays a major role in its stock price. Strong sales growth, especially in key markets like the U.S., Europe, and South Korea, can boost investor confidence and push the share price higher. However, declining demand due to economic slowdowns or changing consumer preferences can negatively impact stock performance.

2. Electric Vehicle (EV) Growth and Innovation

The automotive industry is rapidly shifting toward electric vehicles (EVs). Hyundai has been expanding its EV lineup with models like the IONIQ series. If the company successfully captures market share in the EV segment, it can positively impact the stock. However, slow adaptation or strong competition from Tesla and other EV makers could pose risks.

3. Raw Material Costs and Supply Chain Stability

Hyundai relies on materials like steel, lithium (for EV batteries), and semiconductor chips. If raw material prices increase or if supply chain disruptions occur, production costs may rise. Higher costs can reduce profit margins, which might lower the stock price. On the other hand, stable supply chains and cost-effective production help improve financial performance.

4. Global Economic Conditions

Economic factors like inflation, interest rates, and consumer spending power directly impact car sales. In times of economic growth, more people buy cars, which benefits Hyundai. However, during recessions or high inflation periods, demand for new vehicles drops, affecting the company’s revenue and share price.

5. Competition and Market Position

Hyundai competes with major global automakers like Toyota, Ford, and Volkswagen. If Hyundai launches innovative models with better features, fuel efficiency, or pricing, it can gain market share and boost its stock price. However, if competitors outperform Hyundai in key markets, it could impact the company’s growth and investor sentiment.

6. Government Regulations and Policies

Automobile companies must comply with government rules on emissions, safety, and fuel efficiency. Favorable policies, such as subsidies for electric vehicles, can benefit Hyundai. However, stricter regulations or new taxes on vehicle manufacturers could increase costs and affect profit margins, influencing the share price.

Risks and Challenges for Hyundai Motor Share Price

Hyundai Motor is a global automobile leader, but like any company, it faces several risks that can impact its share price. Here are six key challenges that could affect Hyundai Motor’s stock performance:

1. Global Economic Slowdowns

The automobile industry is highly dependent on economic conditions. During economic downturns or recessions, consumers tend to cut back on big purchases like cars. If global economic growth slows down, Hyundai’s sales may decline, affecting its revenue and share price.

2. Rising Raw Material Costs

Hyundai relies on key materials such as steel, lithium (for EV batteries), and semiconductor chips. If the prices of these raw materials increase, the company’s production costs rise, reducing profit margins. Higher costs can make Hyundai’s vehicles more expensive, which could impact demand and stock performance.

3. Intense Competition in the Auto Industry

Hyundai faces tough competition from major car manufacturers like Toyota, Volkswagen, Tesla, and emerging Chinese EV brands. If competitors launch better, more affordable, or more technologically advanced vehicles, Hyundai may lose market share. This can affect its sales growth and investor confidence.

4. Supply Chain Disruptions

The global automobile industry has faced supply chain issues, including chip shortages and delays in raw material shipments. If Hyundai experiences disruptions in sourcing key components, it could slow down production, leading to fewer vehicle deliveries and a potential decline in stock price.

5. Changing Government Regulations

Governments worldwide are enforcing stricter emission norms and safety regulations. If Hyundai fails to meet these evolving standards, it may face fines, production delays, or increased costs for compliance. Additionally, if governments reduce incentives for electric vehicles, Hyundai’s EV segment could be impacted, affecting stock performance.

6. Shifting Consumer Preferences

The automotive market is changing rapidly, with more consumers preferring electric vehicles (EVs), hybrid cars, or smart mobility solutions. If Hyundai does not adapt quickly to these trends or if its EV models fail to attract customers, it could lose potential market share, negatively impacting its future growth and stock value.

Read Also:- ITC Share Price Target 2025 To 2030- Today Chart, Market Overview, More Details