Hyundai Motor India is one of the leading automobile companies in the country, known for its reliable and stylish vehicles. The company’s share price reflects its strong market presence, innovation in electric and fuel-efficient cars, and growing customer demand. Investors closely watch Hyundai’s stock performance as it is influenced by industry trends, government policies, and global economic conditions. Hyundai Motor India Share Price on 31 January 2025 is 1,676.00 INR. This article will provide more details on Hyundai Motor India Share Price Target 2025, 2026 to 2030.

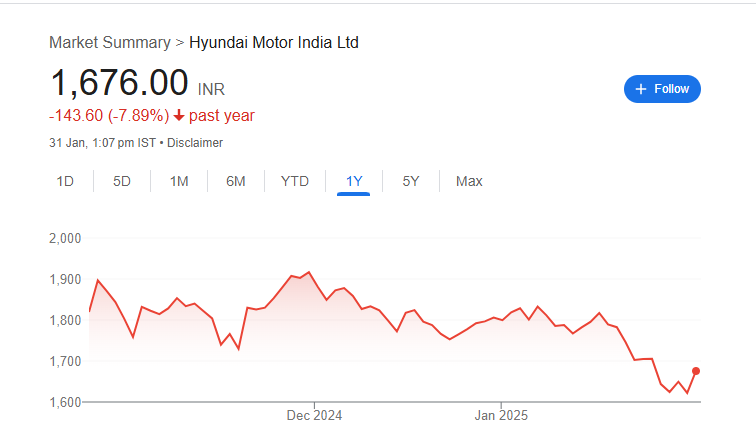

Hyundai Motor India Share Price Chart

Hyundai Motor India Share Details

- Open:- 1,638.00

- High:- 1,681.85

- Low:- 1,630.35

- Previous Close:- 1,622.00

- Volume:- 259,742

- Value (Lacs):- 4,353.28

- VWAP:- 1,658.18

- UC Limit:- 1,784.20

- LC Limit:- 1,459.80

- 52 Week High:- 1,970.00

- 52 Week Low:- 1,610.65

- Mkt Cap (Rs. Cr.):- 136,181

- Face Value:- 10

Hyundai Motor India Share Price Target 2025 To 2030

- 2025 – ₹1970

- 2026 – ₹2120

- 2027 – ₹2350

- 2028 – ₹2550

- 2029 – ₹2700

- 2030 – ₹3010

Hyundai Motor India Shareholding Pattern

- Promoters: 82.50%

- Mutual Funds: 5.10%

- Foreign Institutions: 6.70%

- Domestic Institutions: 2.03%

- Retail and Other: 3.67%

Major Factors Affecting Hyundai Motor India Share Price

-

Market Demand for Automobiles

The demand for cars and SUVs directly impacts Hyundai Motor India’s share price. If more customers buy Hyundai vehicles, the company’s revenue and profits increase, leading to a rise in share value. Factors such as festive seasons, economic conditions, and interest rates on car loans influence this demand. - New Vehicle Launches and Innovation

Hyundai frequently introduces new models with advanced features, electric vehicle (EV) technology, and improved safety. Successful new launches can attract more customers and investors, boosting the company’s market value. On the other hand, if a new model fails to perform well, it may negatively affect the share price. - Raw Material Costs and Supply Chain Stability

The prices of essential materials like steel, aluminum, and lithium (for EV batteries) significantly impact production costs. If these costs rise, Hyundai may have to increase car prices, which could reduce demand. Additionally, any supply chain disruptions, such as semiconductor shortages, can slow down production and affect stock performance. - Government Policies and Regulations

Policies related to taxation, fuel efficiency norms, and incentives for electric vehicles play a major role in Hyundai’s growth. Favorable government policies, such as subsidies for EV production, can boost sales and improve share price trends. However, stricter emission norms or higher taxes can increase costs, affecting profitability. -

Global Economic Conditions and Competition

As Hyundai operates in a competitive industry, its stock performance is influenced by global economic conditions, interest rates, inflation, and competitor strategies. Strong competition from brands like Maruti Suzuki, Tata Motors, and emerging EV manufacturers can impact Hyundai’s market share and stock value.

Risks and Challenges for Hyundai Motor India Share Price

-

Intense Market Competition

The Indian automobile industry is highly competitive, with strong players like Maruti Suzuki, Tata Motors, and Mahindra, along with emerging electric vehicle (EV) brands. If Hyundai fails to maintain its market share with new innovations and competitive pricing, it may face challenges in sustaining its stock performance. - Raw Material Price Fluctuations

The cost of essential raw materials like steel, aluminum, and lithium for EV batteries can fluctuate due to global supply and demand changes. A sharp rise in these prices increases Hyundai’s production costs, which may impact its profit margins and, in turn, its stock value. - Economic Slowdowns and Interest Rates

A weak economy can reduce consumer purchasing power, leading to lower demand for vehicles. Additionally, high interest rates on car loans can make vehicle financing expensive, discouraging potential buyers and affecting Hyundai’s sales and stock price. - Regulatory and Environmental Challenges

Stricter government regulations on emissions, safety standards, and vehicle electrification can increase Hyundai’s compliance costs. If the company fails to adapt to new policies or faces penalties, it could negatively affect investor confidence and share price growth. - Global Supply Chain Disruptions

Hyundai relies on a global network of suppliers for key components like semiconductors and EV batteries. Any disruption, such as geopolitical tensions, shipping delays, or manufacturing shutdowns, can slow production and impact vehicle availability, leading to lower sales and stock volatility. -

Shifting Consumer Preferences

The growing demand for electric and hybrid vehicles means Hyundai must invest heavily in EV technology. If the company is unable to keep up with changing consumer preferences or competitors’ advancements in EVs, it may struggle to maintain its position in the market, impacting its long-term stock performance.

Read Also:- Jio Financial Services Share Price Target 2025 To 2030- Chart, Market Capital, More Details