HBL Power Systems is a leading company in batteries and power solutions, serving industries like defense, railways, aviation, and industrial sectors. Investors closely watch HBL’s share price as the company continues to expand its business and adopt new technologies. HBL Share Price on 25 February 2025 is 465.75 INR. This article will provide more details on HBL Share Price Target 2025, 2026 to 2030.

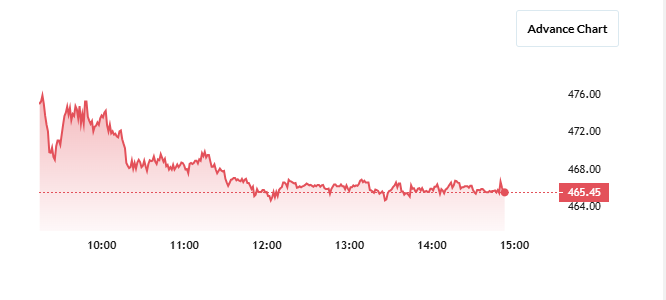

HBL Share Price Chart

HBL Share Details

- Open: 470.05

- High: 478.00

- Low: 463.50

- Previous Close: 470.20

- Volume: 506,406

- Value (Lacs): 2,358.59

- VWAP: 469.56

- UC Limit: 564.20

- LC Limit: 376.20

- 52 Week High: 739.65

- 52 Week Low: 378.20

- Mkt Cap (Rs. Cr.): 12,910

- Face Value: 1

HBL Share Price Target 2025 To 2030

- 2025 – ₹740

- 2026 – ₹1000

- 2027 – ₹1340

- 2028 – ₹1545

- 2029 – ₹1750

- 2030 – ₹1955

HBL Shareholding Pattern

- Promoters: 59.11%

- Mutual Funds: 0.19%

- Foreign Institutions: 5.22%

- Domestic Institutions: 0.20%

- Retail and Other: 35.28%

Major Factors Affecting HBL Share Price

HBL Power Systems is a leading company in batteries, electronics, and power solutions, serving industries like defense, railways, and aviation. Its share price is influenced by several key factors, including market demand, financial performance, and technological advancements. Here are five major factors that affect HBL’s stock price:

1. Growth in the Energy & Battery Industry

HBL operates in the power and energy sector, which is seeing rising demand for advanced battery solutions in electric vehicles (EVs), renewable energy, and defense applications. If the battery industry grows, HBL can expand its business, leading to higher revenue and a potential rise in share price. However, slower industry growth can have the opposite effect.

2. Company’s Financial Performance

HBL’s quarterly earnings, revenue growth, and profit margins directly impact investor confidence. Strong financial results can attract more investors and boost share price, while declining profits, increasing debt, or high operational costs may negatively affect stock performance.

3. Technological Innovations & Product Development

HBL is known for innovation in battery technology and power systems. If the company develops new, efficient, and cost-effective solutions, it can gain a competitive edge, leading to higher sales and a rise in stock value. However, failure to keep up with new technology may result in losing market share to competitors.

4. Government Policies & Defense Contracts

HBL supplies batteries and power solutions to defense, railways, and aerospace sectors, which depend on government policies and contracts. If the government increases spending on defense and infrastructure, HBL could benefit, pushing its share price higher. However, policy changes, delays, or budget cuts in these sectors may impact the company’s revenue and stock performance.

5. Market Competition & Global Demand

HBL competes with both domestic and international companies in the battery and power sector. If competitors offer better products at lower prices, HBL may face challenges in maintaining market share, affecting its share price. Additionally, global demand for batteries and power solutions influences stock performance, especially if exports or international contracts increase.

Risks and Challenges for HBL Share Price

HBL Power Systems is a well-known player in the battery and power solutions industry, catering to defense, railways, aviation, and industrial sectors. While the company has strong growth potential, its share price faces several risks and challenges that could impact investor confidence. Here are five key risks and challenges affecting HBL’s stock performance:

1. Fluctuations in Raw Material Prices

HBL depends on key raw materials like lithium, lead, and other metals for battery production. If the prices of these materials rise due to supply chain disruptions, global shortages, or inflation, production costs may increase. This can reduce profit margins and negatively impact the company’s share price.

2. High Market Competition

The battery and power sector is highly competitive, with both domestic and international players offering advanced and cost-effective solutions. If competitors provide better technology or lower-priced alternatives, HBL may lose market share, which could lead to lower revenue and a decline in stock price.

3. Dependence on Government & Defense Contracts

A significant portion of HBL’s business comes from government projects and defense contracts. Any delays, cancellations, or policy changes in government spending could directly impact the company’s revenue. If HBL loses major contracts, its growth prospects and stock value may suffer.

4. Technological Advancements & Changing Industry Trends

The battery and energy sector is evolving rapidly, with new technologies such as solid-state batteries and alternative energy storage solutions emerging. If HBL fails to keep up with technological advancements, it risks becoming less competitive, which could impact its long-term stock performance.

5. Global Economic Slowdowns & Market Volatility

HBL’s share price, like most stocks, is affected by overall market conditions and economic trends. During economic slowdowns, recessions, or stock market crashes, investors may pull out funds from mid-sized companies like HBL, leading to a drop in its share price. Uncertainty in global trade and economic instability can also impact investor sentiment.

Read Also:- Urban Enviro Share Price Target 2025 To 2030- Chart, Market Overview, More Details