Cressanda Solutions is a growing company in the IT and digital services industry, attracting the attention of many investors. Its share price reflects the company’s financial performance, market position, and growth potential. Investors looking at Cressanda Solutions stock often consider factors like business expansion, new projects, and overall industry trends. Cressanda Solutions Share Price on 13 February 2025 is 6.45 INR. This article will provide more details on Cressanda Solutions Share Price Target 2025, 2026 to 2030.

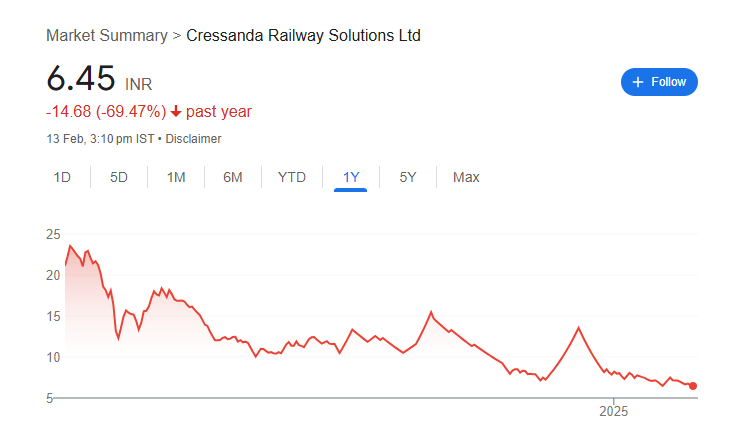

Cressanda Solutions Share Price Chart

Cressanda Solutions Share Details

- Open: 6.46

- High: 6.65

- Low: 6.41

- Previous Close: 6.54

- Volume: 741,875

- Value (Lacs): 47.85

- VWAP: 6.48

- UC Limit: 6.86

- LC Limit: 6.22

- 52 Week High: 24.48

- 52 Week Low: 6.20

- Mkt Cap (Rs. Cr.): 272

- Face Value: 1

Cressanda Solutions Share Price Target 2025 To 2030

- 2025 – ₹25

- 2026 – ₹32

- 2027 – ₹38

- 2028 – ₹44

- 2029 – ₹50

- 2030 – ₹56

Cressanda Solutions Shareholding Pattern

- Promoters: 0.07%

- Mutual Funds: 0%

- Foreign Institutions: 0%

- Domestic Institutions: 0.02%

- Retail and Other: 99.91%

Major Factors Affecting Cressanda Solutions Share Price

Cressanda Solutions is a growing company in the technology and digital solutions space. Its share price is influenced by various internal and external factors that impact its growth and investor confidence. Here are some key factors affecting Cressanda Solutions’ share price:

-

Company Performance and Financial Growth

The company’s revenue, profit margins, and overall financial health play a crucial role in determining its share price. Consistent growth in earnings and a strong balance sheet can attract investors, leading to higher stock prices. -

Market Demand for Digital Solutions

As Cressanda Solutions operates in the IT and digital services industry, the demand for its services impacts its stock value. Increased adoption of digital transformation solutions by businesses can boost the company’s revenue and positively influence its share price. -

New Contracts and Business Expansion

Winning new contracts, forming partnerships, or expanding into new markets can drive investor confidence. If the company secures major deals or expands its services, the stock price may see an upward trend. -

Overall Stock Market Trends

The performance of the broader stock market and sector-specific trends impact Cressanda Solutions’ share price. If the IT and technology sector is performing well, it can positively influence the company’s stock. However, market downturns can lead to declines. -

Investor Sentiment and Speculation

Stock prices are also influenced by investor perception and speculation. Positive news, analyst recommendations, and strong quarterly results can increase investor confidence, leading to price appreciation. Conversely, negative news can cause short-term fluctuations.

Risks and Challenges for Cressanda Solutions Share Price

Investing in Cressanda Solutions comes with opportunities, but there are also certain risks and challenges that can affect its share price. Here are some key factors investors should consider:

-

Market Competition and Industry Challenges

The IT and digital solutions industry is highly competitive, with many established players. If Cressanda Solutions faces strong competition or fails to keep up with changing technology trends, it may struggle to grow, impacting its stock price. -

Financial Performance and Profitability Concerns

If the company reports lower revenues, declining profit margins, or increased operational costs, investor confidence could weaken. Any inconsistency in financial performance may lead to stock price volatility. -

Regulatory and Compliance Risks

Changes in government policies, data security regulations, or industry compliance standards can affect the company’s operations. If Cressanda Solutions faces legal or regulatory challenges, it may impact business growth and share value. -

Stock Market Volatility and Economic Conditions

Broader market trends and economic factors, such as inflation, interest rate changes, or global financial instability, can influence investor sentiment. During economic downturns, IT stocks, including Cressanda Solutions, may face price declines. -

Dependence on Key Clients and Contracts

A significant portion of the company’s revenue may come from a few key clients or projects. If any major client terminates its contract or reduces spending, it could negatively impact financial stability and lead to a drop in share price.

Read Also:- Atul Share Price Target 2025 To 2030- Chart, Market Overview, More Details