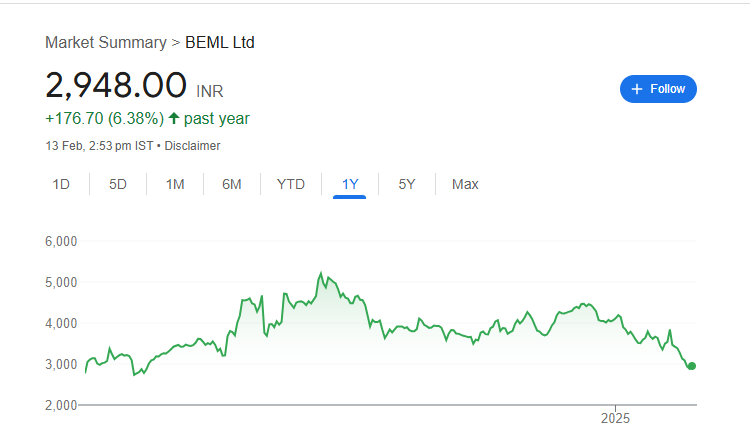

BEML Limited is a well-known public sector company in India, playing a key role in defense, railways, and construction industries. Its share price reflects the company’s strong market presence, government contracts, and overall financial performance. Investors closely watch BEML’s stock as it is influenced by factors like government policies, infrastructure growth, and global economic trends. BEML Share Price on 13 February 2025 is 2,948.00 INR. This article will provide more details on BEML Share Price Target 2025, 2026 to 2030.

BEML Share Price Chart

BEML Share Details

- Open: 2,890.05

- High: 3,050.95

- Low: 2,890.05

- Previous Close: 2,884.00

- Volume: 420,481

- Value (Lacs): 12,419.75

- VWAP: 2,990.44

- UC Limit: 3,460.80

- LC Limit: 2,307.20

- 52 Week High: 5,488.00

- 52 Week Low: 2,671.90

- Mkt Cap (Rs. Cr.): 12,300

- Face Value: 10

BEML Share Price Target 2025 To 2030

- 2025 – ₹5490

- 2026 – ₹5700

- 2027 – ₹5900

- 2028 – ₹6200

- 2029 – ₹6500

- 2030 – ₹6700

BEML Shareholding Pattern

- Promoters: 54.03%

- Mutual Funds: 15.94%

- Foreign Institutions: 7.41%

- Domestic Institutions: 2.16%

- Retail and Other: 20.45%

Major Factors Affecting BEML Share Price

-

Government Orders and Defense Contracts

BEML (Bharat Earth Movers Limited) is a key supplier of defense and railway equipment. Its share price is highly influenced by government orders and defense contracts. When the company secures large contracts from the Indian government or other organizations, investor confidence increases, leading to a rise in share price. -

Infrastructure and Railway Expansion

As BEML plays a significant role in metro rail projects and heavy engineering, its stock performance is linked to infrastructure growth in India. If the government announces new metro rail or railway expansion projects, it boosts the demand for BEML products, positively impacting its share price. -

Privatization and Divestment Plans

The Indian government has been working on privatization and divestment plans for several public sector companies, including BEML. Any announcement regarding stake sales or privatization can lead to fluctuations in share price, depending on investor sentiment and market conditions. -

Financial Performance and Profitability

BEML’s quarterly earnings, revenue growth, and profitability directly impact its stock price. Strong financial results and increasing profit margins attract more investors, pushing the stock higher, while weak earnings can lead to a decline in share price. -

Global Market and Raw Material Costs

The prices of raw materials such as steel, aluminum, and other metals used in manufacturing BEML’s equipment affect its production costs. If raw material prices rise, it may reduce profit margins, impacting investor confidence and the stock price negatively. Conversely, lower raw material costs can improve profitability and boost share price.

Risks and Challenges for BEML Share Price

-

Dependence on Government Contracts

A major portion of BEML’s revenue comes from government contracts, especially in the defense, railway, and metro sectors. Any delay in government orders, policy changes, or budget cuts can negatively impact the company’s financial performance and lead to fluctuations in its share price. -

Privatization and Stake Sale Uncertainty

The Indian government’s plan to divest its stake in BEML creates uncertainty in the market. While privatization may bring efficiency and better management, concerns about future leadership, operational changes, or bidder interest can create short-term volatility in the stock price. -

Rising Raw Material Costs

BEML relies on raw materials like steel, aluminum, and other metals for manufacturing. If the prices of these materials rise due to inflation or supply chain disruptions, the company’s production costs increase. This could lower profit margins and impact investor confidence in the stock. -

Global and Domestic Economic Slowdown

Economic downturns, both in India and globally, can affect infrastructure spending and defense budgets. If government spending on railways, defense, or metro projects slows down, it could reduce demand for BEML’s products, leading to lower revenues and a potential decline in share price. -

Intense Competition in the Sector

BEML faces strong competition from both domestic and international players in the defense, railway, and construction equipment industries. If competitors offer better technology, lower prices, or faster delivery, BEML may lose market share, affecting its growth prospects and share price.

Read Also:- Indus Tower Share Price Target 2025 To 2030- Chart, Market Overview, More Details