Anant Raj is a well-known name in the real estate sector, with a strong presence in residential, commercial, and hospitality projects. The company’s share price reflects its business growth, market trends, and investor confidence. Many investors closely track Anant Raj’s stock performance to make informed decisions. Anantraj Share Price on 14 February 2025 is 549.90 INR. This article will provide more details on Anantraj Share Price Target 2025, 2026 to 2030.

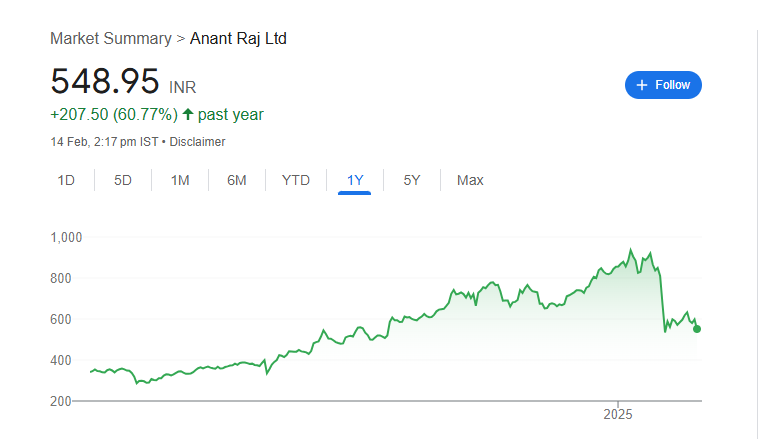

Anantraj Share Price Chart

Anantraj Share Details

- Open: 597.75

- High: 601.00

- Low: 543.00

- Previous Close: 597.60

- Volume: 1,444,643

- Value (Lacs): 7,986.71

- VWAP: 569.29

- UC Limit: 657.35

- LC Limit: 537.85

- 52 Week High: 947.90

- 52 Week Low: 281.00

- Mkt Cap (Rs. Cr.): 18,901

- Face Value: 2

Anantraj Share Price Target 2025 To 2030

- 2025 – ₹950

- 2026 – ₹1150

- 2027 – ₹1350

- 2028 – ₹1550

- 2029 – ₹1750

- 2030 – ₹1950

Anantraj Shareholding Pattern

- Promoters: 60%

- Mutual Funds: 5.07%

- Foreign Institutions: 13.07%

- Domestic Institutions: 1.64%

- Retail and Other: 20.22%

Major Factors Affecting Anantraj Share Price

-

Real Estate Market Trends

Anant Raj operates in the real estate sector, which means its share price is highly dependent on overall market trends. If the demand for residential and commercial properties is strong, the company benefits, leading to a positive impact on its stock price. However, a slowdown in the real estate sector can affect growth prospects. -

Government Policies and Regulations

Changes in government policies, such as interest rates on home loans, real estate development regulations, and taxation, can influence Anant Raj’s business performance. Supportive policies can boost investor confidence, while strict regulations may pose challenges. -

Financial Performance and Earnings Growth

Investors closely watch Anant Raj’s revenue, profit margins, and debt levels. If the company shows strong earnings growth and financial stability, its share price tends to rise. On the other hand, weak financial results may cause a decline in investor interest. -

Infrastructure and Urban Development Projects

As a real estate developer, Anant Raj benefits from increased infrastructure projects and urban expansion. Government initiatives in smart cities, highways, and metro projects can boost demand for properties, positively impacting its stock price. -

Market Sentiment and Investor Confidence

The overall stock market conditions and investor sentiment also play a key role in Anant Raj’s share price movement. Positive news, strong economic growth, and increased investments in the real estate sector can drive the stock price higher, while market uncertainty can create downward pressure.

Risks and Challenges for Anantraj Share Price

-

Fluctuations in the Real Estate Market

The real estate sector is highly cyclical, meaning demand can rise and fall depending on economic conditions. If there is a slowdown in property sales or a decline in real estate prices, Anant Raj’s revenue and profitability may be affected, leading to volatility in its share price. -

Regulatory and Legal Challenges

The real estate industry is subject to strict government regulations, land acquisition laws, and taxation policies. Any unfavorable changes, such as increased taxes or delays in project approvals, can impact the company’s growth and investor confidence. -

High Debt and Interest Rate Sensitivity

Real estate companies often rely on loans to finance large-scale projects. If interest rates increase, borrowing costs rise, which can affect Anant Raj’s profitability. A high debt burden can also make it challenging to maintain financial stability. -

Competition from Other Real Estate Developers

Anant Raj faces competition from other well-established real estate companies. If competitors launch better projects, offer lower prices, or have stronger financial backing, it could impact Anant Raj’s ability to attract customers and investors, affecting its stock performance. -

Market Sentiment and Economic Uncertainty

Investor confidence plays a key role in stock price movement. Factors such as inflation, economic downturns, or global financial instability can create uncertainty in the stock market. If investors lose confidence in the real estate sector, Anant Raj’s share price may experience downward pressure.

Read Also:- SRF Share Price Target 2025 To 2030- Chart, Market Overview, More Details