Investors looking at Afcons Infrastructure are eager to know its future share price trends. As a leading player in the construction and engineering sector, the company’s stock performance depends on various factors like project wins, financial health, and industry growth. Understanding these aspects can help investors make better decisions. Afcons Infrastructure Share Price on 06 February 2025 is 452.70 INR. This article will provide more details on Afcons Infrastructure Share Price Target 2025, 2026 to 2030.

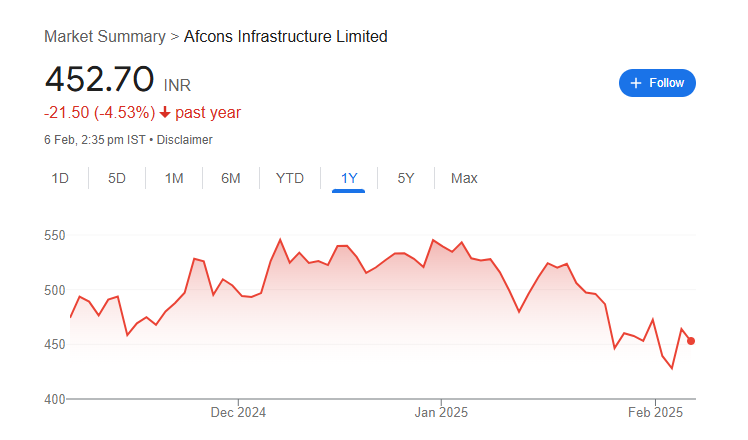

Afcons Infrastructure Share Price Chart

Afcons Infrastructure Share Details

- Open: 468.35

- High: 477.10

- Low: 452.00

- Previous Close: 464.00

- Volume: 1,146,792

- Value (Lacs): 5,196.69

- VWAP: 463.93

- UC Limit: 556.80

- LC Limit: 371.20

- 52 Week High: 570.00

- 52 Week Low: 420.25

- Mkt Cap (Rs. Cr.): 16,666

- Face Value: 10

Afcons Infrastructure Share Price Target 2025 To 2030

- 2025 – ₹570

- 2026 – ₹630

- 2027 – ₹680

- 2028 – ₹730

- 2029 – ₹780

- 2030 – ₹830

Afcons Infrastructure Shareholding Pattern

- Promoters: 50.17%

- Mutual Funds: 5.93%

- Foreign Institutions: 18%

- Domestic Institutions: 5.19%

- Retail and Other: 20.72%

Major Factors Affecting Afcons Infrastructure Share Price

Afcons Infrastructure’s share price is influenced by several key factors:

- Project Acquisitions: Securing significant contracts can boost investor confidence. For instance, in January 2025, Afcons received a ₹1,283 crore project for a marine package in Gujarat, enhancing its market position.

- Financial Health: The company’s financial metrics, such as revenue growth and profit margins, play a crucial role. As of the latest reports, Afcons has an operating revenue of ₹22,355.29 crore, with a 6% annual growth rate and a pre-tax margin of 5%.

- Debt Levels: Managing debt is vital for financial stability. Afcons maintains a reasonable debt-to-equity ratio of 17%, indicating a healthy balance sheet.

- Market Sentiment: Investor perceptions can cause share price fluctuations. Following its IPO in November 2024, Afcons’ shares initially dipped but later rose by 8.4%, reflecting changing market sentiments.

- Industry Trends: The infrastructure sector’s overall health impacts Afcons. Factors like government spending on infrastructure and economic conditions can influence the company’s performance and, consequently, its share price.

-

Operational Efficiency: Efficient project execution and timely completion can enhance profitability and reputation, positively affecting the share price. Delays or cost overruns, on the other hand, may have adverse effects.

Risks and Challenges for Afcons Infrastructure Share Price

Afcons Infrastructure, a leading construction and engineering company, faces several risks and challenges that can impact its share price. Here are five key factors:

1. Project Delays and Cost Overruns

Large infrastructure projects often face delays due to regulatory approvals, land acquisition issues, or unforeseen challenges like weather conditions. If Afcons struggles to complete projects on time or within budget, it can lead to financial losses and negatively affect investor confidence.

2. High Debt Levels

Infrastructure companies usually take on large amounts of debt to finance projects. If Afcons’ debt levels increase significantly, it may struggle with interest payments, reducing profitability. Investors may become cautious, leading to a dip in share price.

3. Economic Slowdowns

Infrastructure growth depends on a strong economy and government spending. During economic downturns, infrastructure projects may slow down due to budget cuts, reduced investments, or policy changes. This can lower the company’s revenue and put pressure on its stock value.

4. Regulatory and Environmental Challenges

Government policies, legal regulations, and environmental clearances play a crucial role in infrastructure development. Stricter laws or unexpected policy changes can increase costs and delay projects, impacting Afcons’ financial performance and stock price.

5. Competitive Pressure

Afcons competes with other major construction firms for contracts. If competitors offer lower bids or more efficient solutions, Afcons may lose key projects. A weaker order book can result in lower future earnings, affecting investor sentiment and share price movement.

Read Also:- Ireda Share Price Target 2025 To 2030- Chart, Market Overview, More Details