Adani Enterprises is a prominent player in India’s infrastructure, energy, and logistics sectors. Over the years, the company has made substantial growth, contributing to its strong market presence. For investors, understanding the share price target of Adani Enterprises is crucial to making informed decisions. Adani Enterprises Share Price on 28 February 2025 is 2,293.10 INR. This article will provide more details on Adani Enterprises Share Price Target 2025, 2026 to 2030.

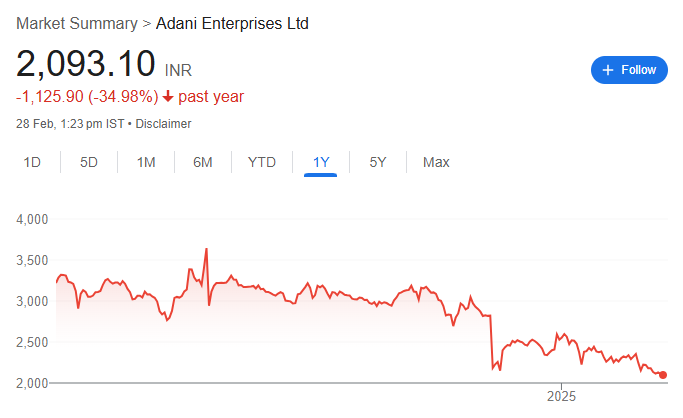

Adani Enterprises Share Price Chart

Adani Enterprises Share Details

- Open – 2,107.00

- Previous Close – 2,110.95

- Volume – 849,506

- Value (Lacs) – 17,773.79

- High – 2,111.35

- Low – 2,072.00

- UC Limit – 2,322.00

- LC Limit – 1,899.85

- 52 Week High – 3,743.90

- 52 Week Low – 2,025.00

- Face Value – 1

Adani Enterprises Share Price Target 2025 To 2030

- 2025 – ₹3750

- 2026 – ₹4200

- 2027 – ₹4970

- 2028 – ₹5700

- 2029 – ₹6400

- 2030 – ₹7100

Adani Enterprises Shareholding Pattern

- Promoters: 73.93%

- Mutual Funds: 2.37%

- Foreign Institutions: 11.73%

- Domestic Institutions: 4.25%

- Retail and Other: 7.69%

Major Factors Affecting Adani Enterprises Share Price

-

Global Commodity Prices

Adani Enterprises is involved in sectors like energy, infrastructure, and commodities. Fluctuations in global commodity prices, especially coal and oil, can significantly impact the company’s profitability. A rise or fall in these prices can directly influence its revenue and, consequently, its share price. - Government Policies and Regulations

As Adani operates in industries such as energy, mining, and logistics, any changes in government regulations, environmental policies, or taxation can affect its operations. Favorable policies might drive growth, while stricter regulations could lead to higher compliance costs, impacting share prices. - Expansion Plans and Project Execution

Adani Enterprises is known for its ambitious expansion plans, such as increasing its capacity in renewable energy and building large-scale infrastructure projects. The successful execution of these projects can enhance the company’s financial position and increase investor confidence, boosting the share price. - Market Sentiment and Investor Perception

The share price of Adani Enterprises can be significantly influenced by market sentiment. Investor perception regarding the company’s financial health, leadership, and growth potential plays a vital role. Positive news or financial performance can lead to higher stock demand, increasing the share price, while negative sentiment can have the opposite effect. -

Global Economic Conditions

Adani Enterprises operates in multiple international markets, and global economic conditions like recessions, trade wars, or inflation can impact the company’s performance. Economic downturns can lead to reduced demand for Adani’s products and services, which in turn may put downward pressure on its share price. Conversely, a strong economy boosts business and profitability, pushing the share price upward.

Risks and Challenges for Adani Enterprises Share Price

-

Environmental and Regulatory Risks

Adani Enterprises operates in sectors like mining, energy, and infrastructure, which are heavily regulated by environmental laws. Any changes in these regulations, or delays in approvals for projects, can increase costs or slow down operations. This could negatively affect the company’s profitability and impact its share price. - Debt Levels and Financial Health

The company has a significant amount of debt due to its large-scale infrastructure and energy projects. High levels of debt can be risky, especially during economic downturns or if interest rates rise. If the company struggles to manage its debt or its financial position weakens, investors may lose confidence, causing the share price to drop. - Market Volatility and Economic Slowdowns

Like many large companies, Adani Enterprises’ share price is vulnerable to broader market volatility. Economic slowdowns, both locally and globally, can reduce demand for its services and products. If the global or domestic economy faces challenges, it could lower the company’s earnings, which would negatively affect its share price. - Public Perception and Media Scrutiny

Adani Enterprises has faced media scrutiny and criticism on various fronts, such as environmental concerns and corporate governance. Negative press or public protests could harm the company’s image, causing investors to lose confidence. This may lead to lower demand for the stock, impacting its share price. - Commodity Price Fluctuations

As Adani Enterprises deals with commodities like coal and oil, fluctuations in global commodity prices can impact its profits. A drop in prices, especially for coal, could hurt the company’s revenue from its mining and energy sectors. If these prices fall significantly, it could hurt the share price. -

Execution Risk of Expansion Plans

Adani Enterprises has aggressive expansion plans in renewable energy and infrastructure. However, the successful execution of these projects is not guaranteed. If the company faces delays, cost overruns, or fails to meet targets, it could affect its revenue and growth potential, leading to a decline in share price.

Read Also:- BEL Share Price Target 2025 To 2030- Chart, Market Capital, More Details