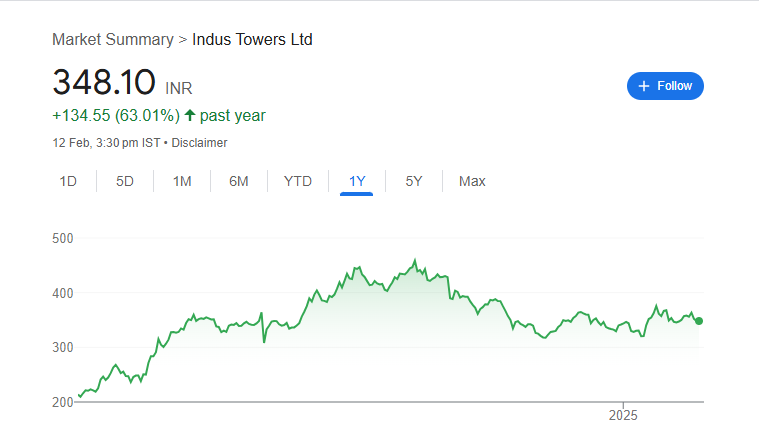

Indus Towers is a leading telecom infrastructure provider, playing a key role in India’s growing digital network. Its share price reflects the company’s strong presence in the telecom sector, as well as market trends, business performance, and industry developments. Investors looking at Indus Towers often consider factors like telecom operator partnerships, regulatory changes, and future growth opportunities. Indus Tower Share Price on 12 February 2025 is 348.10 INR. This article will provide more details on Indus Tower Share Price Target 2025, 2026 to 2030.

Indus Tower Share Price Chart

Indus Tower Share Details

- Open: 349.00

- High: 350.75

- Low: 332.15

- Previous Close: 348.20

- Volume: 7,020,361

- Value (Lacs): 24,388.73

- VWAP: 345.05

- UC Limit: 383.00

- LC Limit: 313.40

- 52 Week High: 460.35

- 52 Week Low: 207.00

- Mkt Cap (Rs. Cr.): 91,649

- Face Value: 10

Indus Tower Share Price Target 2025 To 2030

- 2025 – ₹465

- 2026 – ₹570

- 2027 – ₹650

- 2028 – ₹760

- 2029 – ₹855

- 2030 – ₹956

Indus Tower Shareholding Pattern

- Promoters: 50%

- Mutual Funds: 13.32%

- Foreign Institutions: 26.15%

- Domestic Institutions: 4.48%

- Retail and Other: 6.04%

Major Factors Affecting Indus Tower Share Price

Indus Towers is one of India’s largest telecom infrastructure providers, playing a key role in the country’s mobile network expansion. Several factors impact Indus Towers’ share price, influencing investor sentiment and stock market performance. Here are the five major factors:

1. Growth in Telecom Industry and 5G Expansion

The demand for mobile connectivity, data usage, and 5G network expansion directly affects Indus Towers’ business. As telecom operators expand their network infrastructure, the company benefits from higher demand for tower installations and maintenance, positively impacting revenue and share price. Any delays in 5G rollout or slowdown in telecom growth can limit revenue potential and put pressure on the stock price.

2. Long-Term Contracts with Telecom Operators

Indus Towers has contracts with major telecom companies like Bharti Airtel and Vodafone Idea. The stability and profitability of these agreements impact investor confidence. If telecom operators face financial troubles or reduce spending on tower infrastructure, Indus Towers’ revenue could be impacted, leading to fluctuations in share price.

3. Government Policies and Regulations

The telecom industry is highly regulated, and changes in government policies, spectrum allocation rules, or taxation can impact Indus Towers’ operations and profitability. Policies supporting telecom expansion benefit the company, while regulations adding higher costs or compliance burdens can negatively affect the stock price.

4. Debt Levels and Financial Performance

Indus Towers’ ability to manage debt, maintain strong earnings, and generate cash flow is crucial for investors. If the company struggles with high debt, lower profit margins, or delays in payments from telecom operators, it may affect investor confidence and cause stock price fluctuations.

5. Competition and Technological Advancements

With the rise of fiber networks, small cell technology, and infrastructure-sharing models, Indus Towers faces competition from other telecom infrastructure providers. If competitors offer cost-effective solutions or new technologies reduce the need for traditional towers, the company’s market position and share price could be impacted.

Risks and Challenges for Indus Tower Share Price

Indus Towers, as a leading telecom infrastructure provider, faces various risks and challenges that can impact its share price and investor confidence. Here are five key risks and challenges:

1. Financial Struggles of Telecom Operators

Indus Towers depends on telecom companies like Bharti Airtel and Vodafone Idea for revenue. If these operators face financial difficulties or delays in payments, it can affect Indus Towers’ cash flow and profitability, leading to stock price fluctuations. Vodafone Idea’s debt issues have been a concern for investors.

2. Regulatory and Policy Changes

The telecom industry is heavily regulated, and changes in government policies, taxation, and spectrum licensing can impact Indus Towers’ operations. Stricter regulations or increased compliance costs could reduce profitability and affect investor sentiment.

3. High Dependence on Limited Clients

Indus Towers relies on a few major telecom operators for most of its revenue. If any client reduces network expansion, switches to another provider, or shuts down operations, it could significantly impact Indus Towers’ business and stock price.

4. Competition from New Technologies

Advancements in fiber networks, small cells, and satellite internet could reduce the need for traditional telecom towers. If telecom operators start shifting to alternative network solutions, it could lower demand for Indus Towers’ services, affecting long-term growth prospects.

5. High Debt and Capital Expenditure

Indus Towers requires huge investments in tower expansion and maintenance. If the company takes on too much debt or struggles to generate sufficient profits, it may face financial pressure. High debt can affect investor confidence and impact share price performance.

Read Also:- Berger Paints Share Price Target 2025 To 2030- Chart, Market Overview, More Details