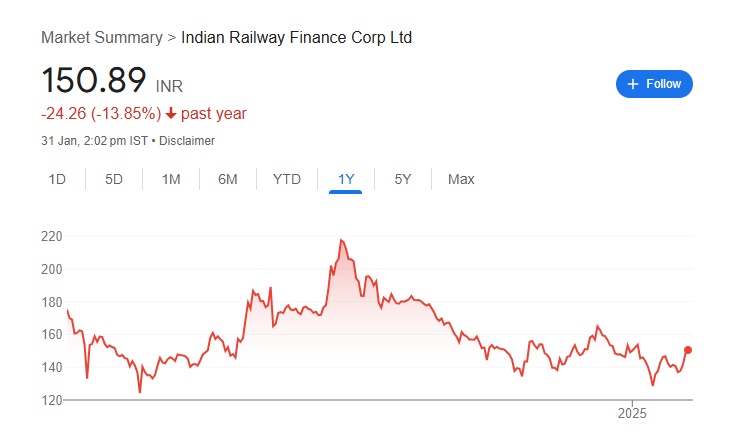

Investors looking at IRFC (Indian Railway Finance Corporation) share price target are keen to understand its future potential. As the key financial arm of Indian Railways, IRFC plays a crucial role in railway development and expansion. With strong government backing, steady earnings, and a focus on long-term infrastructure growth, the stock holds promise for investors. IRFC Share Price on 31 January 2025 is 150.89 INR. This article will provide more details on IRFC Share Price Target 2025, 2026 to 2030.

IRFC Share Price Chart

Indian Railway Finance Corp Share Details

- Open: 149.18

- High: 152.57

- Low: 146.26

- Previous Close: 148.23

- Volume: 39,115,536

- Value (Lacs): 58,947.11

- VWAP: 150.03

- UC Limit: 163.05

- LC Limit: 133.40

- 52 Week High: 229.00

- 52 Week Low: 116.65

- Mkt Cap (Rs. Cr.): 196,942

- Face Value: 10

IRFC Share Price Target 2025 To 2030

- 2025 – ₹250

- 2026 – ₹270

- 2027 – ₹290

- 2028 – ₹310

- 2029 – ₹330

- 2030 – ₹350

IRFC Shareholding Pattern

- Promoters: 86.36%

- Mutual Funds: 0.24%

- Foreign Institutions: 1.01%

- Domestic Institutions: 1%

- Retail and Other: 11.39%

Major Factors Affecting IRFC Share Price

-

Government Policies and Budget Allocation

Since Indian Railway Finance Corporation (IRFC) is closely linked to Indian Railways, any changes in government policies, railway budget allocations, or infrastructure investment can impact its share price. Increased funding for railway projects can boost IRFC’s growth, while budget cuts may slow it down. - Interest Rate Movements

IRFC primarily finances railway projects by borrowing money. If interest rates rise, the cost of borrowing increases, affecting profitability. On the other hand, lower interest rates make borrowing cheaper, which can support business expansion and positively impact the share price. - Expansion of Indian Railways

The growth of Indian Railways, including new projects, modernization, and high-speed rail corridors, can increase the demand for IRFC’s financing services. A strong expansion plan means more business for IRFC, potentially leading to higher stock valuations. - Market Sentiment and Investor Confidence

Like any stock, IRFC’s share price is influenced by investor confidence and overall market sentiment. Positive news, such as strong financial results, government contracts, or railway growth plans, can attract investors, while uncertainties may lead to fluctuations. -

Global Economic Conditions

Economic slowdowns, inflation, or global financial instability can impact IRFC’s stock performance. A weak economy may reduce railway investments, while a strong economy can encourage infrastructure development, supporting IRFC’s long-term growth.

Risks and Challenges for IRFC Share Price

-

Dependence on Indian Railways

IRFC is heavily dependent on Indian Railways for its business. Any delays in railway projects, changes in government policies, or reduction in railway investments can impact IRFC’s revenue and affect its share price. - Interest Rate Fluctuations

IRFC borrows funds to finance railway projects. If interest rates increase, borrowing costs will rise, reducing profitability. Higher interest expenses can put pressure on earnings, making the stock less attractive to investors. - Regulatory and Policy Risks

Being a government-owned company, IRFC is subject to various regulations and policy changes. Any unfavorable policy decisions, such as changes in loan repayment structures or financing terms, could impact IRFC’s financial health and stock performance. - Stock Market Volatility

Like any listed company, IRFC’s share price can be affected by overall market trends. Economic downturns, inflation, or negative global events may cause fluctuations in its stock price, making it less stable for investors. -

Limited Diversification

IRFC primarily focuses on railway financing, which limits its growth opportunities compared to diversified financial institutions. If the railway sector faces slowdowns or lower government spending, IRFC may struggle to find alternative revenue sources, affecting long-term growth.

Read Also:- NTPC Green Share Price Target 2025 To 2030- Current Chart, Market Capital, More Details