ITC Hotels is a prominent name in the luxury hospitality industry, known for its exceptional services and quality accommodations. Investors and enthusiasts often keep a close eye on the ITC Hotels share price to gauge the company’s market performance. The share price reflects how well ITC Hotels is performing financially, which is influenced by factors like demand for luxury travel, competition in the industry, and economic trends. ITC Hotels Share Price on 30 January 2025 is 170.00 INR. This article will provide more details on ITC Hotels Share Price Target 2025, 2026 to 2030.

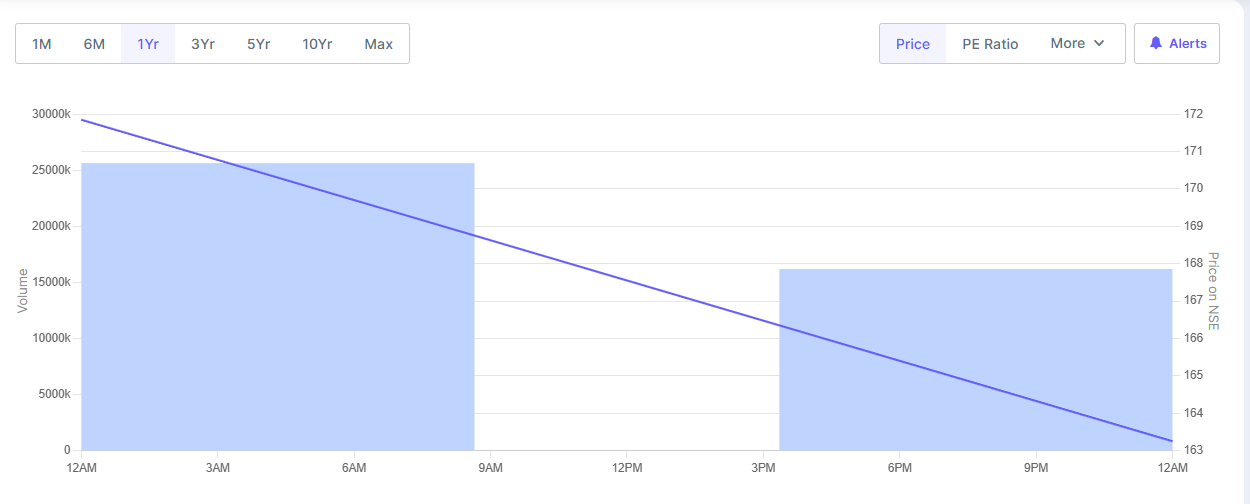

ITC Hotels Share Price Chart

ITC Hotels Share Details

- High: 163.95

- Low: 161.10

- Previous Close: 160.85

- Volume: 4,037,266.30

- Value (Lacs): 6,532.30

- Mkt Cap (Rs. Cr.): 489

ITC Hotels Share Price Target 2025 To 2030

- 2025 – ₹200

- 2026 – ₹250

- 2027 – ₹300

- 2028 – ₹350

- 2029 – ₹400

- 2030 – ₹450

ITC Shareholding Pattern

- Promoters: 0%

- Mutual Funds: 12.87%

- Foreign Institutions: 40.17%

- Domestic Institutions: 32.05%

- Retail and Other: 14.91%

Major Factors Affecting ITC Hotels Share Price

Here are five major factors that can affect Tata Steel’s share price:

- Global Steel Demand: Tata Steel is one of the largest steel manufacturers in India, and the demand for steel, especially in sectors like construction, automotive, and infrastructure, plays a significant role in its profitability. A rise in global demand for steel, especially in emerging markets, can drive Tata Steel’s growth and positively affect its share price.

- Raw Material Prices: The prices of raw materials like iron ore, coal, and other essential inputs directly influence Tata Steel’s production costs. Fluctuations in these raw material prices, especially during periods of supply chain disruptions or price hikes, can significantly impact the company’s profit margins and, in turn, its share price.

- Government Policies and Regulations: Policies and regulations related to the steel industry, such as tariffs, export-import restrictions, and environmental regulations, can affect Tata Steel’s cost structure and operational efficiency. Any changes in government regulations, particularly related to the mining and manufacturing sectors, can lead to volatility in the stock price.

- Exchange Rate Fluctuations: Tata Steel operates internationally, and fluctuations in foreign exchange rates can impact its revenue from exports. A strong rupee, for example, can make Indian steel less competitive in the global market, potentially affecting Tata Steel’s profit margins and share price.

-

Market Competition and Industry Trends: Tata Steel faces competition from both domestic and international steel manufacturers. Changes in market dynamics, such as price wars, new competitors entering the market, or technological advancements, can impact Tata Steel’s market share and financial performance, ultimately influencing its share price.

Risks and Challenges for ITC Hotels Share Price

Here are seven risks and challenges that could affect Tata Steel’s share price:

- Fluctuating Steel Prices: Steel prices can be volatile due to supply and demand imbalances, geopolitical tensions, or changes in raw material prices. If steel prices fall, Tata Steel’s revenue and profitability may be negatively impacted, which could lead to a decrease in its share price.

- Raw Material Price Volatility: The prices of key raw materials like iron ore, coal, and scrap metal can fluctuate based on market conditions. Any significant increase in the cost of these materials can reduce profit margins, posing a risk to Tata Steel’s financial stability and affecting its share price.

- Environmental Regulations: As a major industrial player, Tata Steel is subject to various environmental regulations, both in India and globally. Stricter regulations around carbon emissions and sustainable practices can lead to increased operational costs and affect profit margins, which could impact the company’s share price.

- Economic Slowdown: A slowdown in the global economy or in key markets like China and India can lead to a decrease in demand for steel, especially in sectors like construction and automotive. A downturn in demand can hurt Tata Steel’s revenue and profitability, which could weigh on its share price.

- Debt and Financial Leverage: Tata Steel has made significant investments and acquisitions in the past. If the company’s debt levels rise and it faces difficulties in managing its financial obligations, this could negatively affect investor sentiment and lead to a decline in its share price.

- Geopolitical Risks: Tata Steel operates in multiple countries, making it vulnerable to geopolitical risks such as trade wars, tariff changes, or political instability. These risks can affect international operations and earnings, leading to fluctuations in the share price.

-

Competition and Industry Disruptions: The steel industry is highly competitive, and Tata Steel faces competition from both local and global players. Additionally, industry disruptions, such as technological advancements or the shift towards more sustainable alternatives to steel, could impact the company’s market position and, in turn, its stock price.

Read Also:- Denta Water Share Price Target 2025 To 2030- Share Price, Chart, Market Capital