Jio Financial Services (JFS) is gaining attention as a strong player in India’s financial sector. With the backing of Reliance Industries and a focus on digital finance, the company has great growth potential. Investors are eager to know how JFS will perform in the coming years. Jio Financial Services Share Price on 30 January 2025 is 238.15 INR. This article will provide more details on Jio Financial Services Share Price Target 2025, 2026 to 2030.

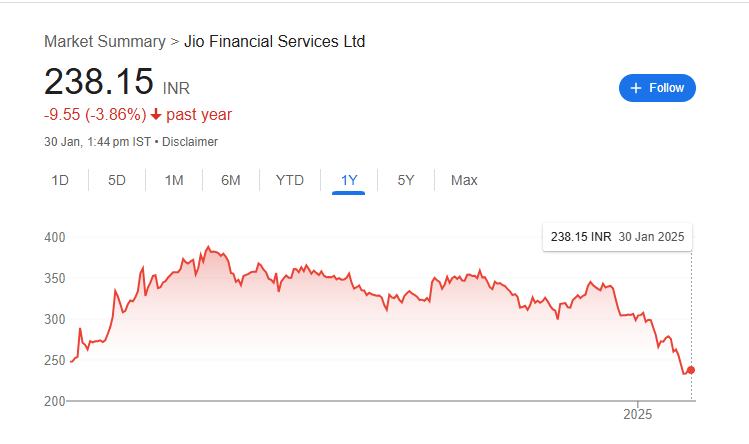

Jio Financial Services Share Price Chart

Jio Financial Services Share Details

- Open: 240.65

- High: 242.25

- Low: 237.70

- Previous Close: 238.30

- Volume: 14,777,367

- Value (Lacs): 35,170.13

- VWAP: 240.02

- UC Limit: 262.10

- LC Limit: 214.50

- 52 Week High: 394.70

- 52 Week Low: 231.05

- Mkt Cap (Rs. Cr.): 151,208

- Face Value: 10

Jio Financial Services Share Price Target 2025 To 2030

- 2025 – ₹400

- 2026 – ₹450

- 2027 – ₹500

- 2028 – ₹550

- 2029 – ₹600

- 2030 – ₹650

Jio Financial Services Shareholding Pattern

- Promoters: 47.12%

- Mutual Funds: 5.13%

- Foreign Institutions: 15.62%

- Domestic Institutions: 7.43%

- Retail and Other: 24.70%

Major Factors Affecting Jio Financial Services Share Price

Jio Financial Services (JFS) is a growing player in India’s financial sector, leveraging the strong backing of Reliance Industries. The share price of JFS depends on several key factors that influence its growth and market performance. Here are five important factors affecting its stock price:

- Expansion in Financial Services

Jio Financial Services is entering multiple financial sectors, including lending, insurance, and digital payments. If the company successfully expands its services and gains market share, investor confidence will grow, leading to a positive impact on its stock price. - Regulatory Environment and Compliance

The financial sector is highly regulated, and JFS must comply with RBI guidelines and government policies. Any changes in regulations, such as stricter lending norms or licensing requirements, can influence its profitability and affect its share price. - Technology and Innovation

JFS benefits from Reliance’s expertise in technology and digital transformation. The company’s ability to introduce innovative financial products, such as AI-driven lending and digital banking solutions, will play a crucial role in attracting customers and investors. - Competition in the Financial Sector

JFS faces strong competition from established banks, NBFCs, and fintech startups. Its ability to compete effectively with market leaders like HDFC Bank, Bajaj Finance, and Paytm will determine its future growth and stock performance. -

Macroeconomic Conditions

Economic factors such as inflation, interest rates, and GDP growth can impact JFS’s business operations. A stable economic environment with increasing digital transactions and financial inclusion can boost its stock, while downturns may pose challenges.

Risks and Challenges for Jio Financial Services Share Price

Jio Financial Services (JFS) is an emerging player in India’s financial market, but its stock price is subject to several risks and challenges. Here are five key factors that could impact its growth and valuation:

- Regulatory and Compliance Risks

The financial industry is heavily regulated, and JFS must comply with guidelines from the Reserve Bank of India (RBI) and other authorities. Any changes in financial regulations, such as stricter lending norms, capital requirements, or data protection laws, could impact its operations and stock price. - High Competition in the Financial Sector

JFS is competing with well-established banks, non-banking financial companies (NBFCs), and fintech firms like HDFC Bank, ICICI Bank, Bajaj Finance, and Paytm. If it struggles to gain market share or faces pricing pressure, it could impact investor confidence and stock performance. - Economic and Market Fluctuations

The stock price of JFS is influenced by overall economic conditions, such as inflation, interest rates, and GDP growth. An economic slowdown or financial crisis could reduce demand for loans and other financial products, affecting the company’s revenue and profitability. - Operational and Technological Risks

As a technology-driven financial company, JFS depends on digital platforms and data security. Any technical failures, cyber threats, or data breaches could damage its reputation and lead to regulatory penalties, negatively affecting its stock price. -

Investor Expectations and Stock Volatility

Being a newly listed company, JFS faces high investor expectations. If the company fails to deliver strong financial results, expand its services, or meet growth targets, it could lead to stock price fluctuations and reduced investor trust.

Read Also:- Wipro Share Price Target 2025 To 2030- Chart, Market Capital, More Details