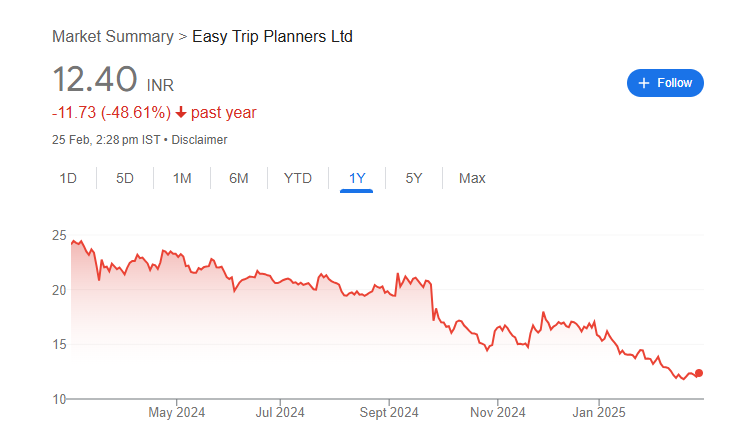

EaseMyTrip (Easytrip) is one of India’s most popular online travel platforms, offering flight bookings, hotel reservations, and holiday packages at competitive prices. Its share price is influenced by factors like travel demand, financial performance, market competition, and economic trends. Easytrip Share Price on 25 February 2025 is 12.40 INR. This article will provide more details on Easytrip Share Price Target 2025, 2026 to 2030.

Easytrip Share Price Chart

Easytrip Share Details

- Open: 12.03

- High: 12.70

- Low: 12.02

- Previous Close: 12.03

- Volume: 22,587,725

- Value (Lacs): 2,803.14

- VWAP: 12.43

- UC Limit: 14.43

- LC Limit: 9.62

- 52 Week High: 25.93

- 52 Week Low: 11.31

- Mkt Cap (Rs. Cr.): 4,398

- Face Value: 1

Easytrip Share Price Target 2025 To 2030

- 2025 – ₹30

- 2026 – ₹40

- 2027 – ₹50

- 2028 – ₹60

- 2029 – ₹70

- 2030 – ₹80

Easytrip Shareholding Pattern

- Promoters: 50.38%

- Mutual Funds: 0.26%

- Foreign Institutions: 2.58%

- Domestic Institutions: 2.74%

- Retail and Other: 44.04%

Major Factors Affecting Easytrip Share Price

EaseMyTrip (Easytrip) is one of India’s leading online travel agencies, offering services like flight bookings, hotel reservations, and holiday packages. Its share price depends on various factors, including travel demand, financial performance, and market trends. Here are five major factors that affect Easytrip’s stock price:

1. Travel & Tourism Industry Growth

The overall growth of the travel and tourism industry has a direct impact on Easytrip’s revenue. When more people travel for business and leisure, the company sees higher bookings, leading to better earnings and a rise in share price. However, travel restrictions, pandemics, or economic slowdowns can reduce demand, negatively affecting the stock.

2. Financial Performance & Profitability

Easytrip’s quarterly earnings, revenue growth, and net profit play a crucial role in determining investor confidence. If the company reports strong financial results, its stock price may rise. On the other hand, declining profits or higher operational costs can lead to a drop in share value.

3. Competition in the Online Travel Industry

The online travel sector is highly competitive, with companies like MakeMyTrip, Yatra, and global travel platforms competing for market share. If Easytrip manages to offer better prices, services, and customer experiences, it can attract more customers and improve its stock value. However, losing market share to competitors may negatively impact the stock.

4. Seasonal Demand & Festive Bookings

Travel demand fluctuates based on seasonal trends and festivals. During peak travel seasons, such as summer vacations, festivals, and holiday weekends, Easytrip’s revenue increases, leading to a potential rise in share price. However, during off-seasons, lower bookings may affect its earnings and stock performance.

5. Technological Advancements & Customer Experience

Easytrip’s ability to adopt new technology and improve its platform affects customer satisfaction and investor confidence. Features like AI-driven recommendations, smooth payment options, and fast customer support can attract more users, boosting revenue and share value. Failure to keep up with tech trends may result in losing customers to competitors.

Risks and Challenges for Easytrip Share Price

EaseMyTrip (Easytrip) is a leading online travel platform in India, but like any business, it faces risks and challenges that can affect its share price. Factors such as market competition, economic conditions, and travel demand play a key role in its stock performance. Here are five major risks and challenges for Easytrip’s share price:

1. Impact of Economic Slowdowns

The travel industry depends on consumer spending, and during times of economic slowdown, recession, or inflation, people tend to reduce travel expenses. This directly affects Easytrip’s revenue and profits, leading to a potential decline in share price.

2. Intense Competition in the Online Travel Market

Easytrip competes with MakeMyTrip, Yatra, Cleartrip, and global travel platforms. If competitors offer better discounts, loyalty programs, or exclusive deals, Easytrip may lose market share. A decline in customer base can negatively impact its stock performance.

3. Regulatory & Government Policy Changes

The travel industry is affected by government regulations, such as changes in tax policies, airline pricing rules, and tourism-related policies. Any new restrictions, increased taxes, or licensing issues could affect Easytrip’s operations and impact investor confidence.

4. Dependence on Airlines & Hotels

Easytrip’s business depends on partnerships with airlines, hotels, and travel service providers. If airlines increase ticket prices, cut commissions, or face operational issues, Easytrip’s revenue may be affected. Similarly, fewer hotel partnerships could lead to limited booking options, reducing customer interest.

5. Technological & Cybersecurity Risks

Being an online travel platform, Easytrip relies heavily on technology and digital security. Any website downtime, app glitches, or cybersecurity breaches can damage customer trust and lead to financial losses. If users face poor service experiences, they may shift to competitors, affecting long-term growth and share value.

Read Also:- MRPL Share Price Target 2025 To 2030- Chart, Market Overview, More Details