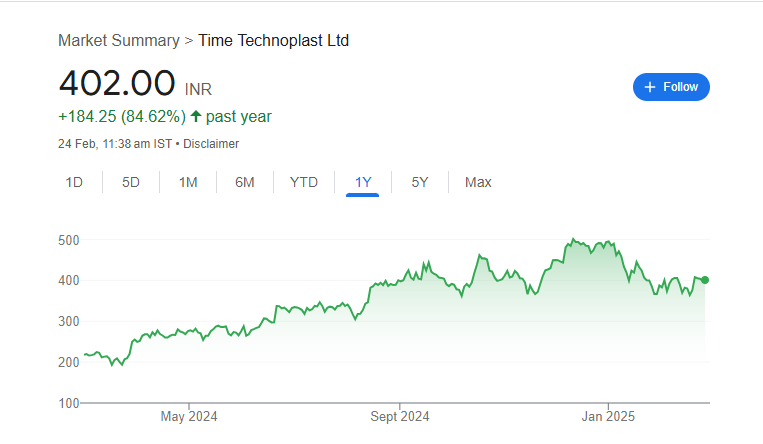

Time Technoplast is a well-established company in industrial packaging, polymer-based products, and infrastructure solutions. Investors closely track its share price as the company continues to grow and expand its market reach. Factors like financial performance, raw material costs, market demand, and economic trends play a crucial role in shaping its stock value. Time Technoplast Share Price on 24 February 2025 is 402.00 INR. This article will provide more details on Time Technoplast Share Price Target 2025, 2026 to 2030.

Time Technoplast Share Price Chart

Time Technoplast Share Details

- Open: 397.15

- High: 404.00

- Low: 387.60

- Previous Close: 399.45

- Volume: 396,357

- Value (Lacs): 1,598.31

- VWAP: 394.08

- UC Limit: 479.30

- LC Limit: 319.60

- 52 Week High: 513.55

- 52 Week Low: 189.25

- Mkt Cap (Rs. Cr.): 9,150

- Face Value: 1

Time Technoplast Share Price Target 2025 To 2030

- 2025 – ₹520

- 2026 – ₹710

- 2027 – ₹915

- 2028 – ₹1120

- 2029 – ₹1325

- 2030 – ₹1530

Time Technoplast Shareholding Pattern

- Promoters: 51.56%

- Mutual Funds: 10.93%

- Foreign Institutions: 7.64%

- Domestic Institutions: 2.27%

- Retail and Other: 27.59%

Major Factors Affecting Time Technoplast Share Price

Here are five major factors that can influence Time Technoplast’s share price, explained in a simple and soft tone:

1. Financial Performance

The company’s financial health plays a significant role in determining its share price. For instance, as of February 21, 2025, Time Technoplast’s share price was ₹410.45, reflecting an increase of 78.11% over the past year. Consistent growth in revenue and profits can boost investor confidence, leading to a rise in share price.

2. Market Demand for Products

Time Technoplast specializes in industrial packaging and infrastructure products. An increase in demand for these products, driven by sectors like manufacturing and construction, can positively impact the company’s sales and, consequently, its share price.

3. Raw Material Costs

The company relies on materials like polymers for production. Fluctuations in the prices of these raw materials can affect production costs. If costs rise and the company cannot pass these increases onto customers, profit margins may shrink, potentially leading to a decrease in share price.

4. Economic Conditions

Broader economic factors, such as GDP growth, industrial activity, and infrastructure development, influence Time Technoplast’s business. A robust economy can lead to higher demand for the company’s products, boosting sales and share price. Conversely, economic downturns may have the opposite effect.

5. Competitive Landscape

The presence of strong competitors in the industrial packaging and infrastructure sectors can impact Time Technoplast’s market share. Innovations, pricing strategies, or enhanced offerings by competitors may pose challenges. Maintaining a competitive edge is crucial for sustaining and potentially increasing the company’s share price.

Risks and Challenges for Time Technoplast Share Price

Here are five risks and challenges that can affect Time Technoplast’s share price, explained in a simple and soft tone:

1. Fluctuating Raw Material Costs

Time Technoplast relies heavily on polymer-based raw materials, which are affected by global crude oil prices. If raw material costs increase sharply, the company’s profit margins may shrink, impacting its financial performance. If the company is unable to pass these costs to customers, it could lead to lower earnings and a drop in share price.

2. Economic Slowdowns & Industrial Demand

Since the company serves industrial, packaging, and infrastructure sectors, its business is directly linked to economic growth. During economic downturns or slow industrial activity, demand for its products may decrease, leading to lower sales and revenue. This could make investors cautious and negatively impact the share price.

3. Intense Market Competition

Time Technoplast competes with both domestic and international players in the industrial packaging and polymer-based product market. If competitors introduce better technology, innovative products, or lower prices, it could result in a loss of market share. This increased competition could put pressure on profitability and stock performance.

4. Regulatory & Environmental Challenges

The plastic and polymer industry faces strict government regulations related to environmental sustainability and waste management. If new policies restrict the use of certain plastic products or require higher compliance costs, the company may have to adjust operations, invest in new technologies, or shift to alternative materials, which could impact profitability and share price.

5. Supply Chain Disruptions

The company relies on smooth supply chains for raw materials and finished products. Global trade issues, shipping delays, or geopolitical tensions can disrupt supplies, leading to production slowdowns and higher costs. These challenges can impact customer deliveries, revenue growth, and ultimately, investor confidence in the stock.

Read Also:- Sky Old Share Price Target 2025 To 2030- Chart, Market Overview, More Details