Investors looking for opportunities in the digital payments and fintech sector often consider Mobikwik shares. The company’s performance, market trends, and future growth potential play a key role in determining its share price. Mobikwik Share Price on 22 February 2025 is 309.80 INR. This article will provide more details on Mobikwik Share Price Target 2025, 2026 to 2030.

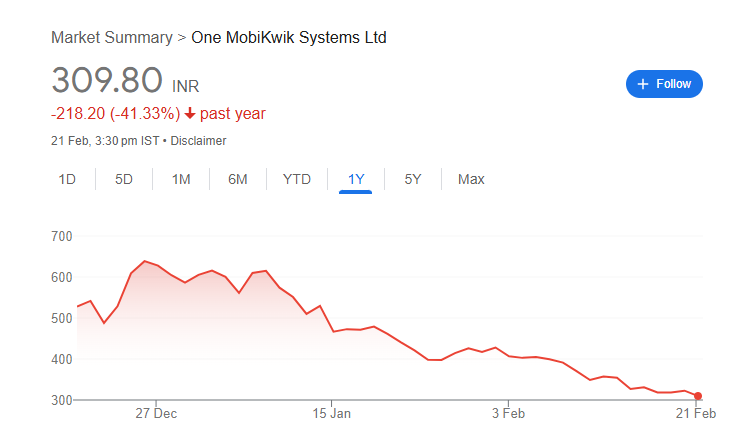

Mobikwik Share Price Chart

Mobikwik Share Details

- Open: 324.40

- High: 333.75

- Low: 308.55

- Previous Close: 322.70

- Volume: 4,078,484

- Value (Lacs): 12,698.36

- VWAP: 319.55

- UC Limit: 387.20

- LC Limit: 258.20

- 52 Week High: 698.30

- 52 Week Low: 308.55

- Mkt Cap (Rs. Cr.): 2,418

- Face Value: 2

Mobikwik Share Price Target 2025 To 2030

- 2025 – ₹700

- 2026 – ₹750

- 2027 – ₹800

- 2028 – ₹850

- 2029 – ₹900

- 2030 – ₹950

Mobikwik Shareholding Pattern

- Promoters: 25.18%

- Mutual Funds: 6.81%

- Foreign Institutions: 4.83%

- Domestic Institutions: 2.04%

- Retail and Other: 61.13%

Major Factors Affecting Mobikwik Share Price

Here are five major factors that can affect Mobikwik share price, explained in a simple and soft tone:

1. Company Growth & Profitability

If Mobikwik grows its business, earns more revenue, and increases profits, investors will gain confidence, and the share price may rise. However, if the company struggles with losses or slow growth, investors may sell their shares, causing the price to drop.

2. Fintech Industry Trends

Since Mobikwik is a digital payments and financial services company, its share price is influenced by fintech industry trends. If digital payments continue to grow and more people use online wallets, the company’s future looks bright. But if the industry slows down due to competition or regulations, the share price could be affected.

3. Competition from Other Companies

Big players like Paytm, PhonePe, and Google Pay are strong competitors. If Mobikwik manages to attract more users and offer better services, its share price can go up. However, if competitors take away market share, it may struggle to grow, leading to a fall in stock value.

4. Government Rules & Regulations

The fintech sector is heavily regulated, and any changes in government policies regarding digital payments, lending, or data security can impact Mobikwik. Favorable policies can help the company grow, while strict regulations can slow down its business, affecting the stock price.

5. Investor Sentiment & Market Conditions

Stock prices also depend on how investors feel about the market. If the economy is doing well, inflation is under control, and people are confident in tech stocks, Mobikwik share price may rise. However, during economic downturns or stock market crashes, the price may drop as investors become cautious.

Risks and Challenges for Mobikwik Share Price

Here are five major risks and challenges that can affect Mobikwik share price, explained in a simple and soft tone:

1. Strong Competition in the Fintech Industry

Mobikwik faces tough competition from big players like Paytm, PhonePe, and Google Pay. If these companies offer better deals, cashback, or new features, Mobikwik may struggle to retain users. Losing customers to competitors can affect its revenue and, in turn, lower the share price.

2. Regulatory and Compliance Risks

The fintech sector is highly regulated, and any changes in government rules regarding digital payments, lending, or data security can impact Mobikwik. If strict regulations are introduced, the company might have to change its business model, which could affect growth and share value.

3. Market Volatility & Economic Conditions

Stock prices often fluctuate due to economic conditions. If inflation is high, interest rates rise, or the stock market crashes, Mobikwik share price may fall. Investors may hesitate to invest in tech stocks during uncertain times, leading to a drop in demand for Mobikwik shares.

4. Cybersecurity & Data Privacy Concerns

Since Mobikwik handles online payments and financial transactions, cybersecurity is a major concern. If there is a data breach or hacking incident, it can hurt the company’s reputation. A lack of trust among users and investors can result in a decline in share price.

5. Profitability & Business Growth Challenges

Many fintech companies operate with high costs and lower profits in the early stages. If Mobikwik struggles to increase profits or fails to expand its business, investors may lose confidence. A slow growth rate can make the share price less attractive in the stock market.

Read Also:- Vikas Lifecare Share Price Target 2025 To 2030- Chart, Market Overview, More Details