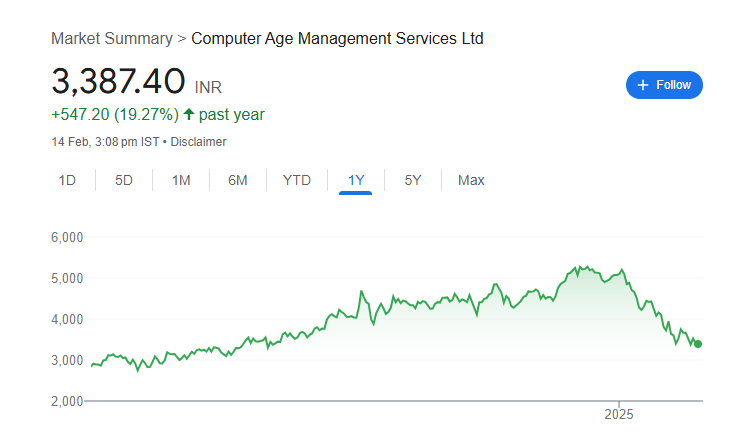

CAMS (Computer Age Management Services) is a leading financial services company that plays a crucial role in managing mutual fund transactions in India. Investors closely watch CAMS’ share price as it reflects the company’s growth, market trends, and overall financial health. Various factors, such as industry performance, regulatory changes, and market conditions, influence its stock movement. Cams Share Price on 14 February 2025 is 3,387.40 INR. This article will provide more details on Cams Share Price Target 2025, 2026 to 2030.

Cams Share Price Chart

Cams Share Details

- Open: 3,438.80

- High: 3,456.20

- Low: 3,312.00

- Previous Close: 3,410.20

- Volume: 311,510

- Value (Lacs): 10,533.09

- VWAP: 3,368.38

- UC Limit: 3,751.20

- LC Limit: 3,069.20

- 52 Week High: 5,367.50

- 52 Week Low: 2,707.10

- Mkt Cap (Rs. Cr.): 16,705

- Face Value: 10

Cams Share Price Target 2025 To 2030

- 2025 – ₹5370

- 2026 – ₹5800

- 2027 – ₹6200

- 2028 – ₹6700

- 2029 – ₹7100

- 2030 – ₹7600

Cams Shareholding Pattern

- Promoters: 0%

- Mutual Funds: 11.37%

- Foreign Institutions: 57.63%

- Domestic Institutions: 5.97%

- Retail and Other: 25.03%

Major Factors Affecting Cams Share Price

-

Performance of the Mutual Fund Industry

CAMS (Computer Age Management Services) plays a crucial role in managing mutual fund transactions. If the mutual fund industry performs well, CAMS benefits from increased transactions and higher revenue. Growth in SIPs (Systematic Investment Plans) and new investments can positively impact its share price. -

Regulatory Changes in the Financial Sector

CAMS operates under strict financial regulations. Any changes in SEBI (Securities and Exchange Board of India) rules, such as new compliance requirements or fee structures, can directly affect its revenue and operational costs, influencing its stock price. -

Technology and Innovation

CAMS relies heavily on technology to provide smooth services. Investment in new technologies, better digital platforms, and automation can improve efficiency and attract more business. On the other hand, cybersecurity threats or outdated systems could negatively impact investor confidence. -

Competition in the Market

CAMS faces competition from other financial service providers and technology-driven firms. If competitors offer better or cheaper services, it could reduce CAMS’ market share, affecting its stock price. However, strong market positioning and partnerships can help maintain its leadership. -

Overall Stock Market and Economic Conditions

Economic conditions like inflation, interest rates, and global financial trends influence investor sentiment. A bullish market can boost investments in mutual funds, benefiting CAMS, while a downturn may slow business, affecting the share price negatively.

Risks and Challenges for Cams Share Price

-

Regulatory Uncertainty

CAMS operates under strict regulations set by SEBI and other financial authorities. Any unexpected regulatory changes, such as new compliance rules or restrictions on fees, can impact the company’s profitability and affect its share price. -

Increased Competition

The financial technology sector is evolving rapidly, with new players entering the market. Competition from other mutual fund service providers, banks, and tech-driven platforms can reduce CAMS’ market share, leading to slower growth and potential stock price fluctuations. -

Dependence on the Mutual Fund Industry

Since CAMS primarily serves mutual fund companies, its business heavily relies on the growth of this industry. If the mutual fund sector faces a slowdown due to economic downturns, declining investor confidence, or regulatory changes, CAMS’ revenue and stock price could be negatively affected. -

Technological Risks and Cybersecurity Threats

As a financial services company, CAMS manages a vast amount of sensitive customer data. Any cybersecurity breach, system failure, or outdated technology could lead to operational disruptions, loss of customer trust, and potential regulatory penalties, impacting its stock performance. -

Economic and Market Fluctuations

Global economic factors like inflation, interest rate hikes, and recession fears can impact investor sentiment. If investors reduce their participation in mutual funds due to market uncertainty, CAMS could experience lower transaction volumes, affecting its revenue and share price.

Read Also:- Rattanindia Power Share Price Target 2025 To 2030- Chart, Market Overview, More Details